Select your investor profile:

This content is only for the selected type of investor.

Institutions & Sub-Advisory?

Private lending: risks rise for a booming market

The private lending market is booming. That brings new investment opportunities – but also increased risks.

- Illiquid leveraged loans increasingly found in mutual funds and ETFs

- Risk is that, in its current shape, the market is largely untested in stress scenarios

- Covenants have weakened, leverage has climbed

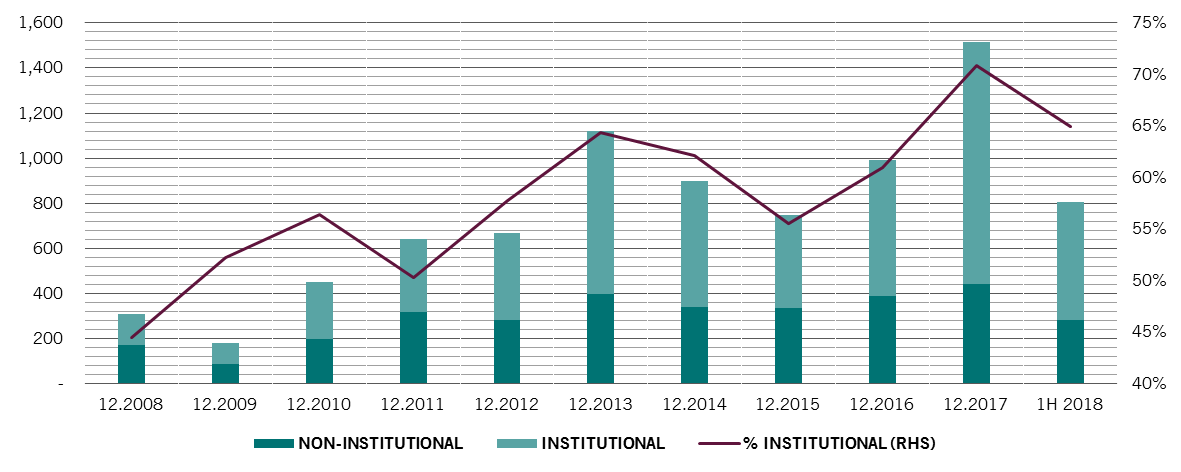

Private lending – once solely the domain of institutional investors – is now increasingly available to private investors. Mutual funds and Exchange-Traded Funds (ETFs) targeting leveraged loans have mushroomed in recent years. The appetite is such that Nest, the UK’s national workplace pension scheme, has called on fund managers to develop “affordable and innovative” private credit vehicles for the defined contribution (DC) retirement saving schemes.

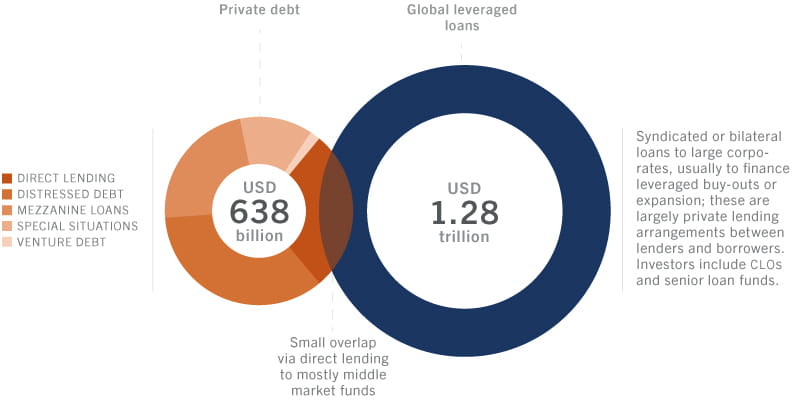

The appeal of private debt is clear. In an era of near-zero interest rates, direct lending offers investors relatively high returns (including an income stream from coupons), combined with lower volatility than high yield bonds. What is more, the market has also become simply too big to ignore as companies that had previously borrowed from banks are now seeking funding directly from investors.

However, all investments come with risks – and in the case of private lending the market’s ability to weather periods of financial or economic turbulence is so far largely untested. It’s particularly worrying that issuers’ leverage is rising while investor protection is weakening. This could exacerbate defaults, with serious implications not only for investors, but also for companies that rely on such financing structures and potentially for the health of the wider economy. The fact that the private debt market is relatively illiquid is likely to amplify any sell-offs and could cause problems for ETFs and mutual funds in particular.

Investors considering making an allocation to private debt must also make sure that their eyes are wide open as to the risks.

Leverage boom

Although the 10-year average annualised total return is still below that of listed high yield, leveraged loans have performed better when adjusted for volatility over that time frame. This is not only because their coupons rise in line with LIBOR but also because such assets sit higher up in a company's capital structure. They have also outperformed in absolute terms over 2018-to-date as rates have gone up.

Another aspect of the private market's growing appeal is that it's becoming deeper and more diverse asset class. A broader range of companies now borrow directly from non-bank entities, partly because regulation has forced the banking industry to scale back lending.

At the same time, companies of all stripes are borrowing more for strategic reasons. Rather than refinancing debt or recapitalising balance sheets, the majority of new leveraged loan issuance over the past five years was to fund mergers and acquisitions or leveraged buy-outs.1 (US M&A deals so far this year have totalled a record USD2.2 trillion).

Less compensation...

Still, investors should tread carefully.

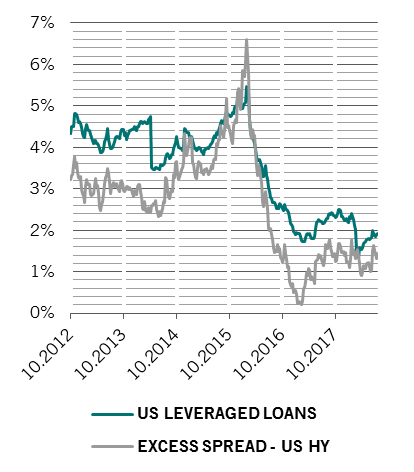

The first reason for caution is the fact that valuations – both for leveraged loans and for high yield – now provide little room for default and recovery. The extra yield, or spread, such assets offer over US government bonds has fallen sharply in recent years (see chart).

The average spread at loan signing date has dropped to 383 basis points by mid-2018 from a peak of 473 basis points in March 2015.3

That matters. If defaults were to rise to 5.5 per cent from about 2 per cent currently – which would still be far short of the 10-15 per cent rates typically seen during recessions – and the recovery rate dropped to 50 per cent, the excess spread would be wiped out by the capital loss. In other words, it would take only a relatively modest deterioration in conditions for investors to lose all the additional compensation these assets are offering in exchange for increased risk and reduced liquidity.

More worrying still, the leveraged loan market tends to feature lower-rated borrowers, with the majority rated B, compared to BB in the high yield market.

The trend towards ever lower compensation for risk is evident across the credit market – internal rates of return (IRRs) on private credit funds have compressed in the face of rising capital inflows and increased competition for assets. Meanwhile, the spread on high-yield bonds have also narrowed significantly, a sign that markets are moving into the latter phases of the credit cycle.

...For more risk

Just as prospective compensation has deteriorated, so too has the credit quality of private debt instruments, with lending terms shifting heavily in favour of borrowers.

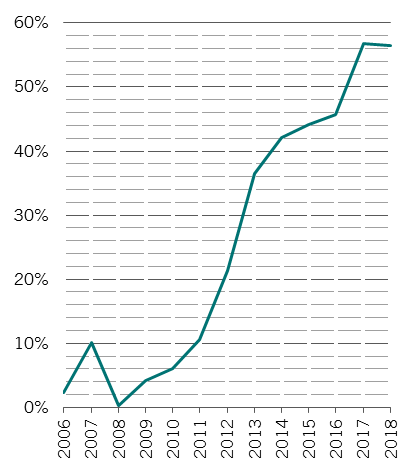

Covenants have weakened. So far this year, 57 per cent of new leveraged loans issued have been “covenant lite”4 – featuring less protection for the lender and giving more flexibility to the borrower in areas like tests on collateral, leverage, payment schedules, etc (see figure 4).

At the same time, leverage has climbed. The share of US leveraged buy-out (LBO) deals levered at six times or higher has gone up to nearly 50 per cent in 2017 from 30 per cent in 2013.5

Such deterioration in companies' credit profile has two potential consequences. First, it will likely lead to lower recovery rates in case of default as the weaker covenants can enable firms to issue more debt than would normally be the case. Not only does that reduce their ability to pay, but it also increases the risk a loan will be subordinated by future borrowing.

Second, it keeps companies alive for longer than may be economically viable – leading to a preponderance of businesses that do not generate enough earnings to cover interest costs. Such "zombies" account for 27 per cent of the US small caps in the Russell 2000 index, up 10 per cent from ten years ago.6

The large volume of investor cash chasing potential investment opportunities means that returns are likely to be lower, too. There was USD236 billion of dry powder in private debt funds as of end-2017 (out of USD667 billion of total AUM).7

Uncharted waters

Any asset comes with risks, and the key to successful investment is to fully understand what those risks might be. Arguably the biggest problem with private credit is that the asset class is largely untested against adverse conditions, having not yet weathered a significant default cycle. The majority of private debt funds were created well after the financial crisis.

Perhaps a bigger problem is that leveraged loans, a traditionally very illiquid asset class, are increasingly structured in vehicles with open-ended liquid structures, such as mutual funds and ETFs. While mutual funds try to manage their redemptions in a way that avoids potential mismatches between flows and the liquidity of the underlying assets, this process can only function well under “normal” market conditions. Investors in ETFs, meanwhile, do not have even this degree of protection. In the case of a major sell-off, most mutual funds allows for so-called gate provision, under which investors wishing to withdraw money join a queue and redemptions are made only gradually. For ETFs, this is not possible, but they will still need to find a buyer in order to meet redemptions, and that may only be possible by significantly lowering prices.

In case of a credit downturn, attempts to sell illiquid assets across such funds can amplify the price movements of the underlying loans. To what extent is yet to be seen.

Investors should, therefore, carefully consider their tolerance for risk. And given the impact leveraged loans can have on corporate capital structures, investors need to think carefully about any other investments they make in these companies.

Some sectors are more exposed than others. Consumer discretionary, telecoms and materials sectors in particular are strongly represented in the “covenant lite” leveraged loan market compared to their overall market capitalisation.

So, as the credit cycle enters its later stages, we are mindful of the risks to the credit market in general and to its private lending segments in particular. Those investing in this asset class should be aware that protection is weaker and returns are lower than has been the case historically. We are more upbeat on private credit funds, which have longer lockups, and better compensation for risks, than on leveraged loans. Nonetheless, we believe that the outlook for these products – as yet untested but likely to be highly correlated to other parts of the credit universe – is uncertain over a two to three-year time horizon.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.