US-China trade war: why China’s policies will keep growth on track.

More growth-supportive fiscal and monetary policies should lift China’s GDP growth next year.

CHINA REACTS TO US TRADE TARIFFS

In the face of US trade tariffs, we expect China’s fiscal and monetary policies to become more growth supportive, providing a lift to GDP growth by some 0.5 per cent next year. Yet, we think Beijing’s stimulus is likely to take longer to work and be less impactful than in previous easing cycles.

Trade policy

Whilst China has already hiked tariffs up to 25 per cent on USD 110 billion of US imported goods, it has cut the import duties it charges to Chinese importers / corporates / consumers and plans further moves. Including additional cuts on most favoured nation (MFN) tariffs due on 1 November, China will have reduced its average MFN tariff from 9.9 per cent to 7.5 per cent, easing the burden on those facing higher US tariffs by lowering duties charged on other countries' imports.

Monetary policy

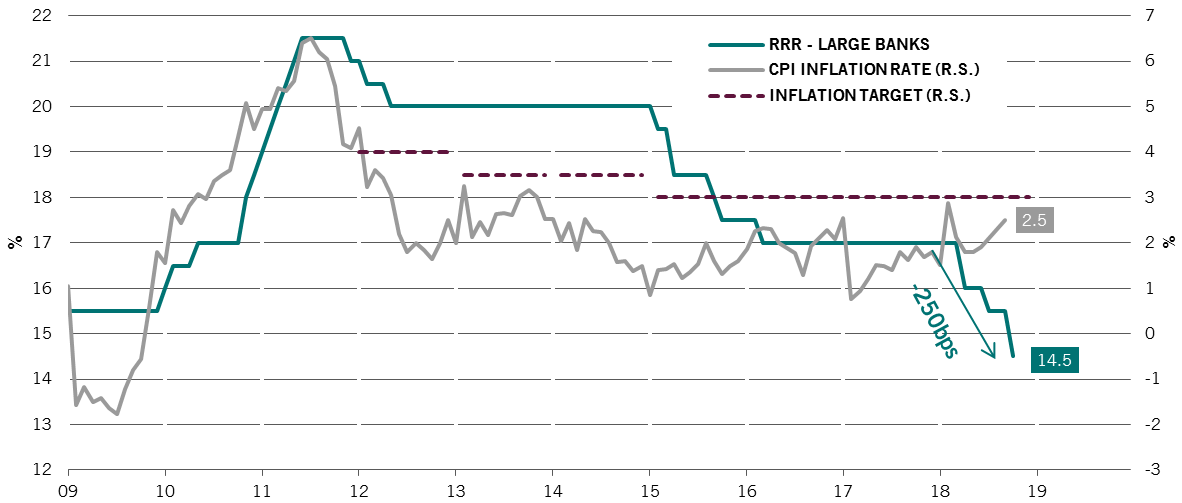

By cutting its reserve requirement ratio (RRR) by 250bps since April, China has sent a clear signal. Already, investment spending has accelerated in real estate and manufacturing in Q3. We think there will be another 100bps RRR cut by March 2019.

Fiscal policy

Also part of the arsenal is a more proactive fiscal policy in the form of tax reduction of RMB1.3 trillion for the whole year. This represents nearly 2 per cent of 2017 GDP, of which some RMB500 billion comes from a cut in individual income tax effective since 1 October.

More measures are expected in 2019, in particular fiscal support for infrastructure investments, cuts in VAT and corporate income tax.

A ROAD FULL OF OBSTACLES: CAPITAL OUTFLOWS, INFLATION & DELEVERAGING

China faces three major hurdles in extending fiscal & monetary stimulus:

- China-US interest rate spread (10 year bond yield spread at a 7 year low at 40bps) & capital outflows risk

- CPI inflation at a 7 month high

- Deleveraging: total social financing at a record high

China has already tightened capital controls to deal with the first hurdle. On inflation, policymakers view the rise as temporary and below the 3% target, so not their prime concern. Finally on deleveraging, it should only resume when trade tensions fade as short-term growth has become the top priority.

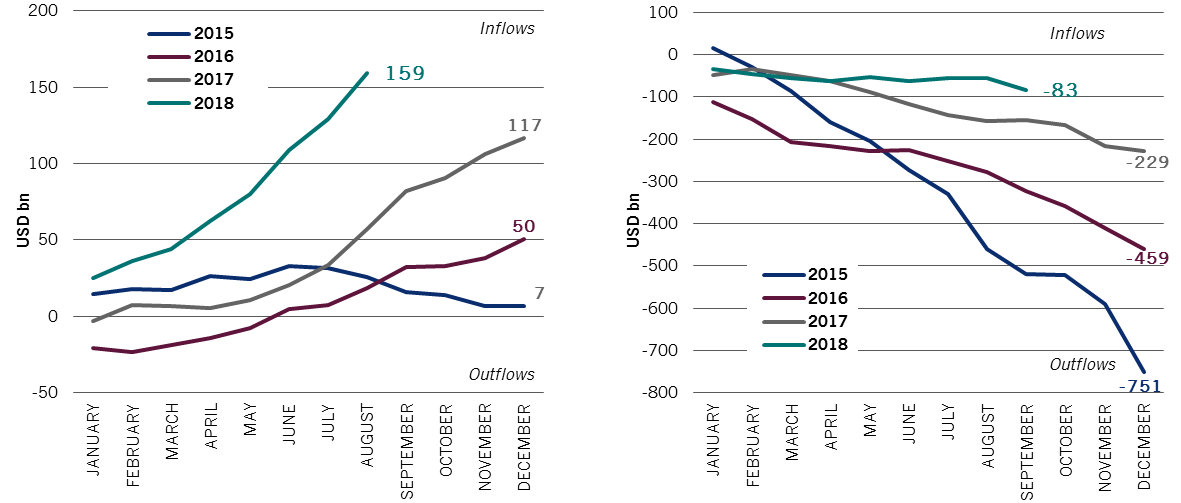

Left chart

Source: Pictet Asset Management, International Institute of Finance (IIF). *Net non-resident purchases of equity & debt. IIF portfolio flows tracker.

Right chart

Source: Pictet Asset Management, CEIC, Datastream. *Changes in FX reserves (net of currency valuation effect) adjusted for current account transactions & net direct investment flows.

So far, measures seem to be working and investors have remained on board. Although China’s capital outflows rose in September, they are still low due to capital controls, representing only half the levels observed in 2017 (right chart). What’s more, over the same period foreign inflows are three times larger last year (left chart).

Added to the expected inclusion of Chinese financial markets into broader market indices, this shows that investor confidence in China remains high.

THE VIEW FROM OUR EMERGING EQUITY TEAM

By Avo Ora, Head of Asia (ex-Japan) Equities

As outlined in the previous section, major policies by China to counter the impact of US tariffs are coming.

The Chinese government has been able to keep options open thanks to the offsetting weakness of the RMB vs. the dollar, but this will not last.

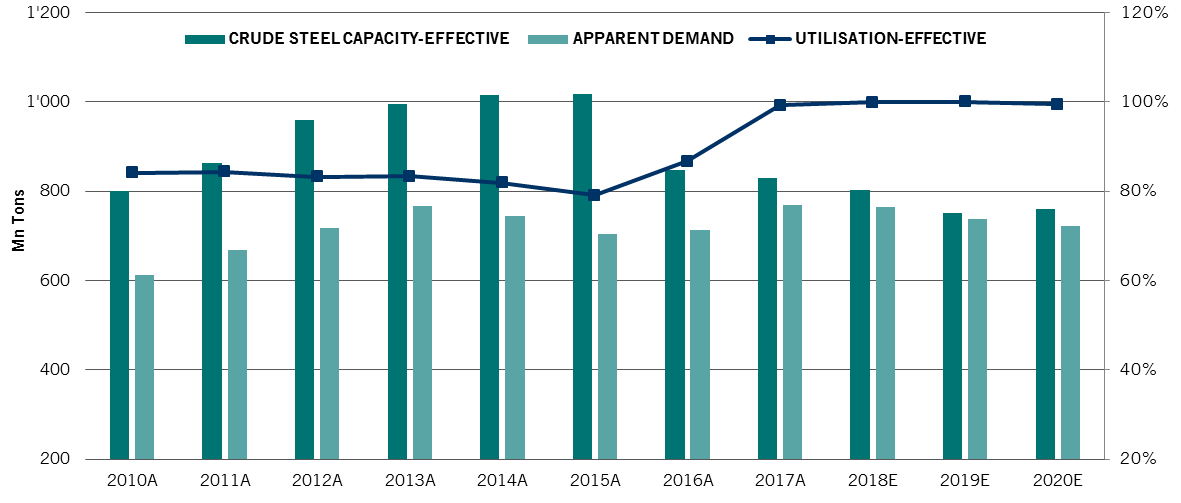

Among their most likely measures, monetary loosening and fiscal stimulus typically support fixed asset investments. This provides an additional leg to the investment thesis behind our holdings in construction-related firms – one being a cement manufacturer, the other a steel producer. These firms not only trade at attractive valuations, but their strong free cash flow generation is now supported by tighter supply conditions due to environmental restrictions put in place by Chinese authorities.

We think the supply side reforms are here to stay and additional stimulus should bring about an encouraging boost to construction activity.

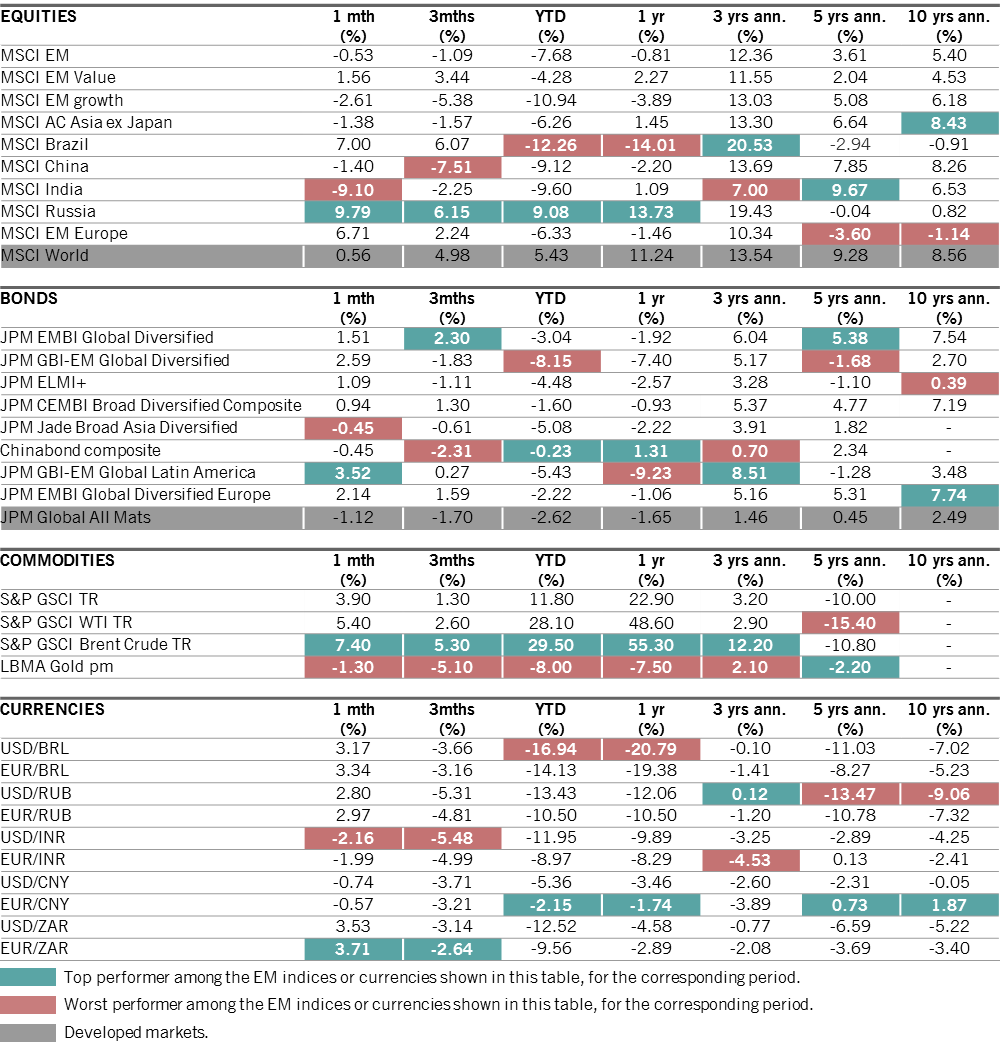

MARKET WATCH

30.09.2018

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.