Beware of fallen angels

BBB-rated bond issuers - those just one notch above high-yield - now make up half the investment grade universe. That could have serious consequences in a downturn.

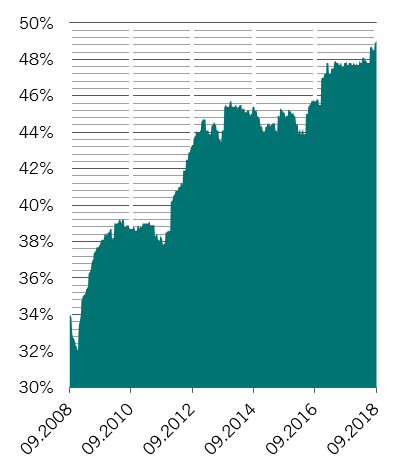

History doesn’t always repeat itself. A profound shift in the US corporate bond market will likely make the next crisis – whenever it comes – look quite different to previous ones. Compared to previous cycles, the proportion of bonds with the lowest possible investment grade rating (IG) – BBB – is exceptionally high, having increased sharply over the past decade. BBB-rated debt now accounts for around half of the whole market in both Europe and the US (see chart).

Share of BBB-rated debt in US IG universe, %

One reason for the increase is that more firms have been turning to the credit market for funding as banks have scaled back lending in response to tougher regulations. At the same time, companies have been borrowing heavily to fund acquisitions – indeed firms operating in the telecom and consumer sectors, which have been particularly active in M&A, make up a substantial proportion of BBB-rated bonds – each sector accounts for around 8 per cent of the universe. Meanwhile, there has also been an increase in debt-funded buybacks and dividend payouts.

Consequently, today’s investment-grade bond market is, in aggregate, significantly more risky than in the past.

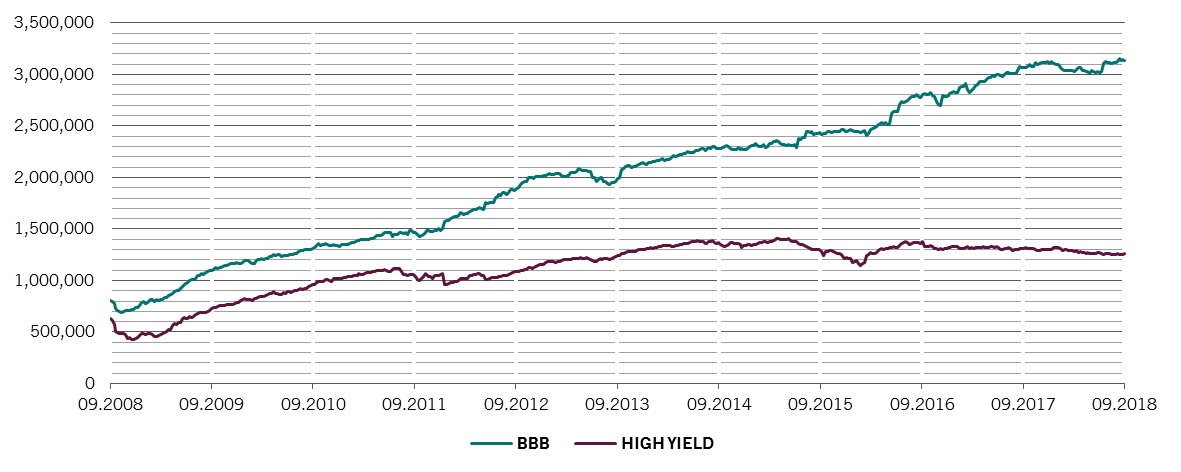

This is a problem because in periods when economies slow, or default rates rise, a significant proportion of BBB-rated borrowers tend to be downgraded as their finances deteriorate. This pushes them out of the investment-grade universe and down in to the high yield market. Sectors that are more defensive and have struggled to keep up with the broader pace of earnings growth would tend to be hit hardest. Portfolios which mostly or exclusively focus on investment-grade debt would therefore be forced to sell.

ICE BofAML US credit market indices, full market value, in USD million

The only way for this mass of fallen angels to be absorbed by the market at a time when liquidity conditions are likely to be strained is through price. This will also affect new issuance, as costs for borrowers rise.

Consequently, we think both investment grade and high-yield bonds are riskier than their yields currently suggest. While we do not anticipate an imminent end to the credit cycle, as it grows ever longer in the tooth ever more stresses will appear. We think the predominance of BBB-rated paper make investment-grade bonds among the least attractive parts of the debt market.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.