Italy's looming budget bust-up

Italy's new coalition government is putting together a populist budget that won't be popular with the EU.

Italy has become the edgy uncle at the family gathering, leaving its European Union partners on perennial tenterhooks.

The latest furore centres on the proposed three year budget being hammered out by Rome’s new populist government.

Lega and Five Star, the two coalition partners, made a series of very expensive promises to Italian voters at this year’s general election. Proposed measures, which are heavily skewed towards transfer payments, include universal income, pension increases and a flat tax. Some public investment also pencilled in, designed to boost growth.

Initially, there were fears that putting these into practice would cause the government’s budget to wildly exceed the deficit limits previously agreed with the EU, ultimately threatening to put Italy in breach of its treaty obligations. At an extreme, an irresponsible budget could potentially lead to Italy’s eventual abandonment of the euro. The markets reacted accordingly, sending spreads on Italian government bonds sharply higher and causing the euro to wobble.

An element of backpedalling took some of the immediate pressure off the markets – maybe the proposed spending programme won’t be as big as investors feared, as suggested by the latest news coming from Rome.

But the tension between trying to satisfy a disgruntled populace and sticking to policies fundamental to membership of the euro suggest that Italy is likely to spur regular bouts of asset volatility – potentially infecting weaker member states.

The devil will be in the detail

Details are thin on the ground, but here’s some of what is being conjectured and our view on how it might matter:

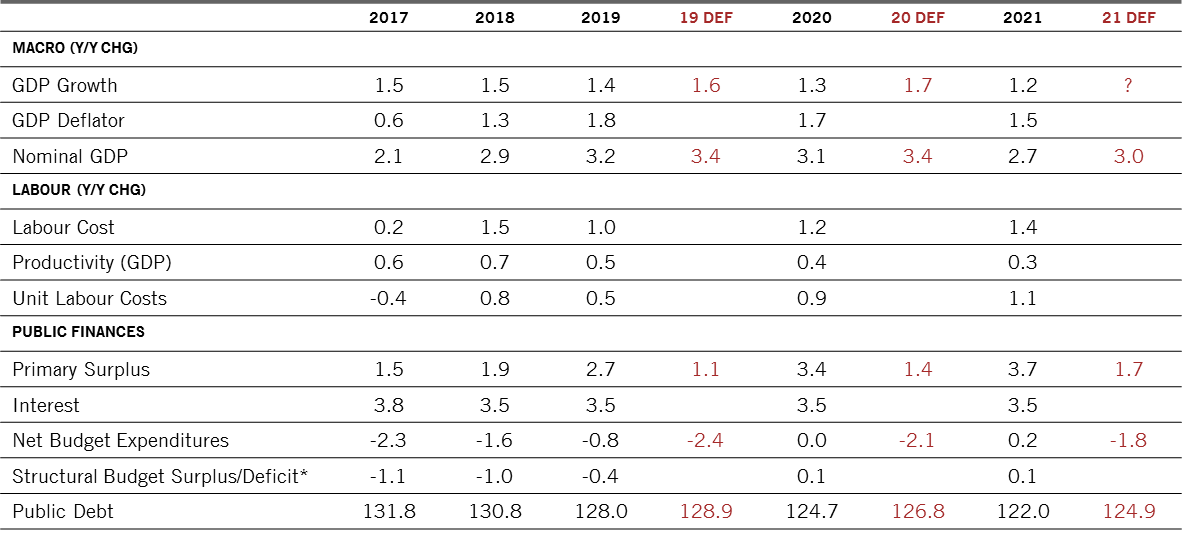

The proposed budget leaves the government with a projected deficit of 2.4 per cent for 2019. That’s, on average, above the 2 per cent deficit previously estimated and well above official Stability and Growth Convergence Programme projections from April, which forecast a 0.8 per cent shortfall next year.

This is not necessarily hazardous to Italy’s financial health. Even with the new projected annual budget deficits, as Italy’s debt service costs remain stable at around 3.5 per cent of GDP, the debt to GDP ratio will not increase as long as nominal economic growth remains above 2 per cent.

The plans will, however, slow the pace at which Italy’s very high public debt to GDP ratio shrinks. Last year’s eye-watering debt ratio of 131.8 per cent was forecast to fall to 122 per cent in 2021 under the old budget projections. The new, higher deficits, would leave that ratio at 124.9 per cent in 2021 – assuming nominal GDP growth declining to 3.0 per cent over the coming three years. It does, however, run counter to requirements laid out by EU treaties.

This leaves Italy’s EU partners with a difficult choice. Do they enforce the bloc’s rules, possibly precipitating political and financial crises? Or do they avoid a confrontation and turn a blind eye to Italy’s transgressions. Signs aren’t hopeful for compromise.

Projections for the Italian economy, public finances and labour market, annual percent change except for public debt which is percentage of GDP

The markets, meanwhile, are trying to absorb all the various permutations. Spreads on Italian government bonds over equivalent German bunds have widened to around 300 basis points, bumping up against the top of recent ranges. About 110 of those basis points are related to redenomination risk, ie that Italy abandons the euro in favour of its own currency. Our models suggest the market is pricing a 10 per cent probability of an Italian exit. And the governing coalition is in no hurry to offer convincing reassurances of a commitment to the single currency.

In part, Italy’s ruling politicians are gambling on three propositions. One, that the EU’s leadership is weaker than ever and that the union’s political landscape will change at the next elections. Two, that anti-establishment parties will win sweeping victories. And three, that the EU will renegotiate its rules if Italy does not comply.

This is the sort of game of political chicken that runs a serious risk of ugly accidents. That’s a problem not just for Italy but for the rest of Europe as well, given that Italy’s financing needs are too big to be covered by EU and European Central Bank safety nets.

At some point in a confrontational process, the threat of leaving the euro zone develops its own unstoppable momentum. If there’s good news for now, it is that this latest iteration of Italian turmoil isn’t infecting other European peripheral markets. The Italian uncle has spilt wine on himself and twisted his ankle trying to jump over chairs, but hasn’t (yet) fallen off the balcony onto anyone.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.