How do your investments impact biodiversity?

Investors beware: biodiversity loss is as serious a threat as climate change. Our model reveals the rate at which different industries are driving species to extinction.

About 250 million years ago, some 96 per cent of animal and plant species perished in what is considered to be the largest of the five mass extinction events on Earth.

Known as “the Great Dying”, the catastrophe was caused by a series of natural disasters – among them, huge volcanic eruptions in Siberia that blasted billions of tonnes of carbon dioxide into the atmosphere and raised global temperatures by 10 degrees centigrade.

Worryingly, scientists believe we are now living through the sixth extinction wave. And unlike the previous five, this one is being caused almost exclusively by humans.

A landmark UN report found human activities such as resource extraction and intensive agriculture are responsible for a catastrophic and unprecedented loss of biological diversity. The report warned a third of all amphibian species and reef-forming corals, 1,000 domesticated breeds of mammals used for food and agriculture and around 10 per cent of insects are in jeopardy.

All in all, one million species are at imminent risk of extinction, endangering ecosystems that are critical to sustaining human life on earth.

The problem is that protecting biodiversity isn't top of the list when it comes to big industry's environmental priorities. Such has been the focus on reducing carbon emissions that most companies would not even consider species loss a corporate responsibility.

That’s dangerously short-sighted. As our research shows, corporations – and their investors – need to pay as much attention to biodiversity as they do to their carbon footprint.

In our analysis, which is described in detail below, we deploy two globally-recognised environmental impact measurement tools – the Planetary Boundaries framework (PB) and Life Cycle Analysis (LCA) – to quantify the corporate world's contribution to species loss.

For changes in biodiversity to remain at natural levels, the model states that the annual extinction rate must be less than 0.13 per million species for every USD1 trillion of revenue generated. Applying this framework to the constituents of MSCI All-Country World Index – which together made more than USD30 trillion in revenue last year – we find that the world's biggest corporations are killing off animal and plant species at a rate that is 22 times greater than the threshold level.

Our analysis showed some of the worst offending industries include leather, hide tan and finishing as well as biofuels.

Investing to limit biodiversity loss

The PB-LCA framework is used in the construction of our Global Environmental Opportunities (GEO) portfolio.

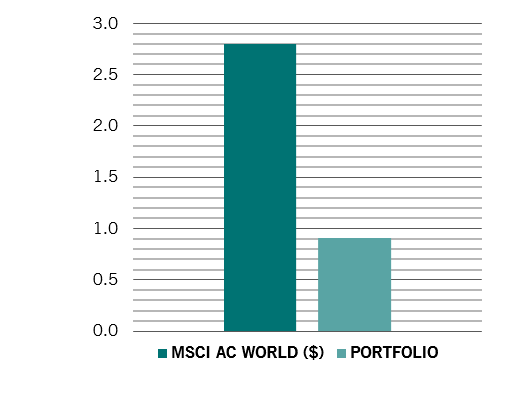

Stocks in GEO have a significantly lower biodiversity footprint than those represented in the MSCI All-Country World equity index.

Rate of extinctions per million species a year per USD trillion of annual revenue

Here's how Pictet-Global Environmental Opportunities strategy works:

- The strategy invests in the shares of companies that are making an active contribution to safeguarding the world’s natural resources.

- Investments are chosen from a broader universe consisting of the world’s 3,500 most environmentally-responsible publicly-held firms – companies that meet the criteria of our proprietary PB-LCA framework.

- The strategy is a concentrated portfolio of 50 to 60 stocks, operating in fields such as pollution control, water supply, renewable energy, waste management and sustainable agriculture.

- With a risk-return profile similar to that of a growth-oriented investment strategy, Pictet AM's Global Environmental Opportunities can be used to complement an equity allocation within a global portfolio.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.