NEWSLETTER

Receive a personalised monthly email that combines all the content in your areas of interest

Sign upReceive a personalised monthly email that combines all the content in your areas of interest

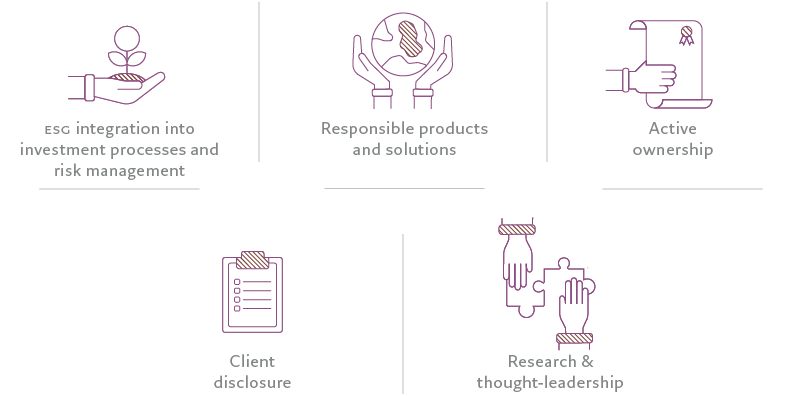

Sign upResponsibility has long been central to our company. We believe we are at the forefront of our industry in incorporating environmental, social and governance (ESG) issues into our investment approaches, actively exercising our rights as investors and engaging with the wider industry.

Integration of ESG factors and sustainability risk has become the norm in our investment processes. We also apply a list of exclusions across all our strategies. For investors who want to go further, our responsible investing strategies focus on companies with stronger governance, as well as cleaner operations and products.

Our ESG focused strategies promote environmental and/or social characteristics. For those investors aiming to achieve an impact, our positive impact strategies target economic activities that are environmentally and/or socially sustainable, such as providing solutions to climate change, energy transition or water scarcity. More information is available in our Responsible Investment policy.

We launched our first ‘best-in-class’ ESG strategy in the late 1990s, focusing on Swiss equities. We then expanded our regional scope, first applying the strategy to the European equity market in 2004 and to the emerging equity market in 2006.

We also offer a range of thematic strategies that invest in companies helping to solve environmental and societal challenges such as water scarcity and climate change. We are perhaps best known as the pioneers in thematic investing. Our experience in the field dates back to the mid-1990s. Since then, we have developed a full range of standalone thematic equity strategies, managed by teams based in our Geneva and Zurich offices. Each one of our thematic strategies, from Water through to Robotics, has a global reach.

We launched the first Water strategy in the industry in 2000. This marked the start of our environmental investment strategies, which now include Clean Energy Transition, Timber, Global Environmental Opportunities and ReGeneration.

More recently we have also developed fixed income and multi asset sustainable products.

We source ESG data from a number of specialist providers and work tirelessly to improve the quality, depth and breadth of the data we use. Data providers include ISS, CFRA, Sustainalytics and Verisk Maplecroft.

We think an active investment approach is particularly important in responsible investing due to the judgement needed to handle some of the complex issues surrounding ethical, moral or business conflicts that may arise from this approach.