Select your investor profile:

This content is only for the selected type of investor.

Investisseurs particuliers?

The risk of staying risk-free

Investors are clinging to cash now that it offers a level of income not seen for more than a decade. But in doing so, they're missing out on much better opportunities.

On the eve of the pandemic, investors were chasing every tiny increment of additional yield. Wherever they could find it. As they had done for much of the post-global financial crisis decade.

It meant Austria could issue 100 year bonds. Companies could borrow at historically low rates with only the lightest of protections for lenders. And the landscape was littered with corporate zombies – heavily leveraged companies whose earnings barely covered interest costs, even at near zero interest rates.

Everything changed with the post-pandemic global surge in inflation.

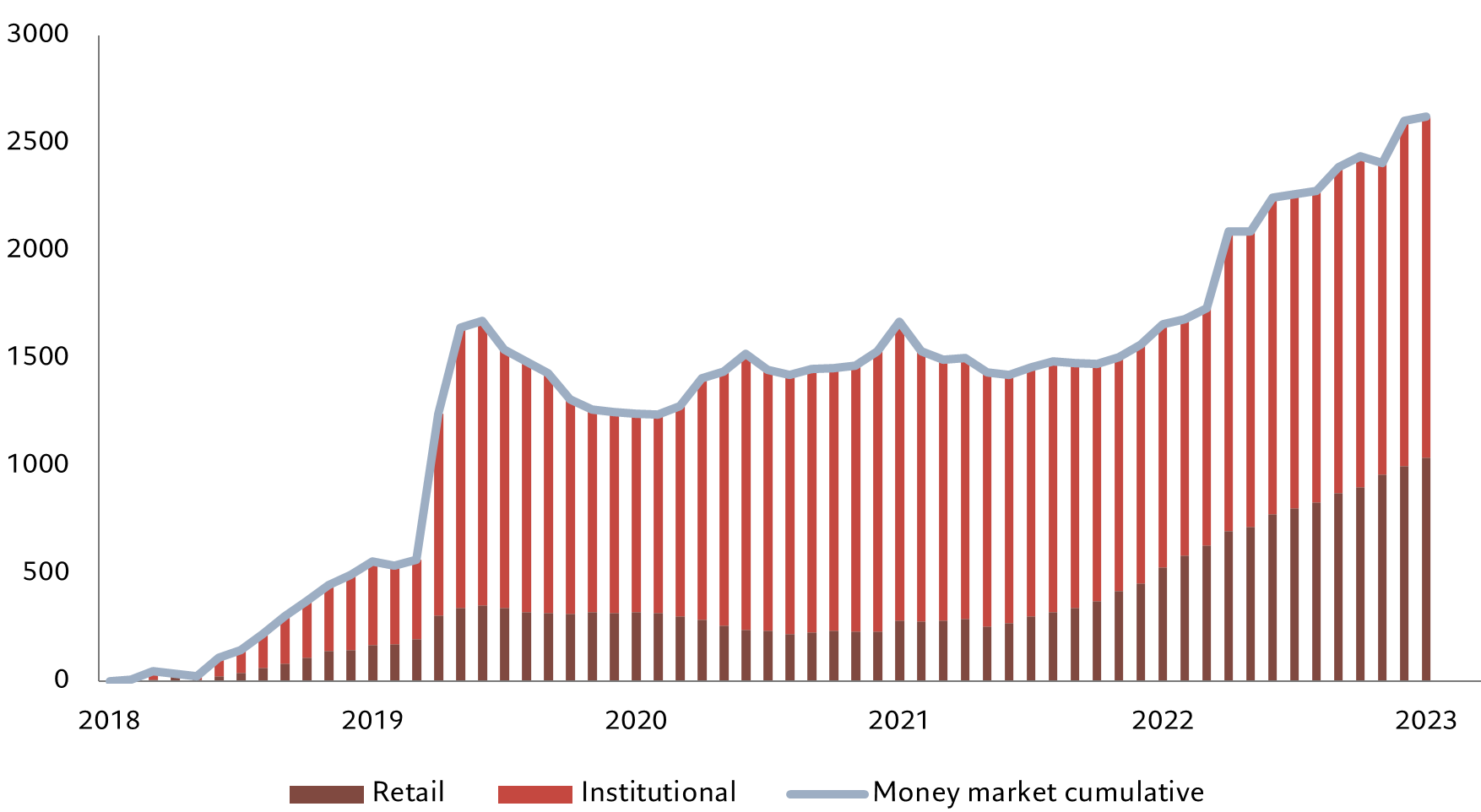

Yet now that investors can earn rich rewards from public asset markets – including double digit yields in parts of the credit and emerging universe – they’re steering clear, clinging to cash instead. Globally investors are holding USD2.6 trillion more in money markets than they did in 2018 (see Fig. 1).

True, for the first time in more than a decade, that cash is generating an attractive return – some 5.1 per cent in the US and 3.8 per cent in the euro zone. Given inflation has fallen back substantially, that’s a significant return in real terms on both sides of the Atlantic.

But with central banks signalling that they’ll be cutting rates, money markets returns have already started to fall, and are likely to drop further – the market is pricing in three quarter-point interest rate cuts in the US this year, which would take official rates to 4.75 per cent.

Yet there’s still a reluctance to draw down holdings of money market instruments and shift capital into higher-yielding assets. In part, it could be that this excessive caution has to do with investors re-calibrating not only their risk appetites but also levels of market risk. For instance, the spike in inflation reminded investors that “risk-free” sovereign debt was anything but. Aggressive rate hikes by central banks led to historic selloffs in bond markets and bouts of extreme volatility. So in 2022, global bonds lost 31 per cent, the biggest loss the fixed income market had suffered since at least 1900.

Even the highest quality “safe haven” US Treasury bonds suffered double digit losses during that year. For investors, those will be painful memories that won’t fade quickly.

And the inversion of the yield curve – shorter maturity debt yielding more than long-dated bonds – makes cash look more attractive. Investors just aren’t being rewarded for taking on maturity risk.

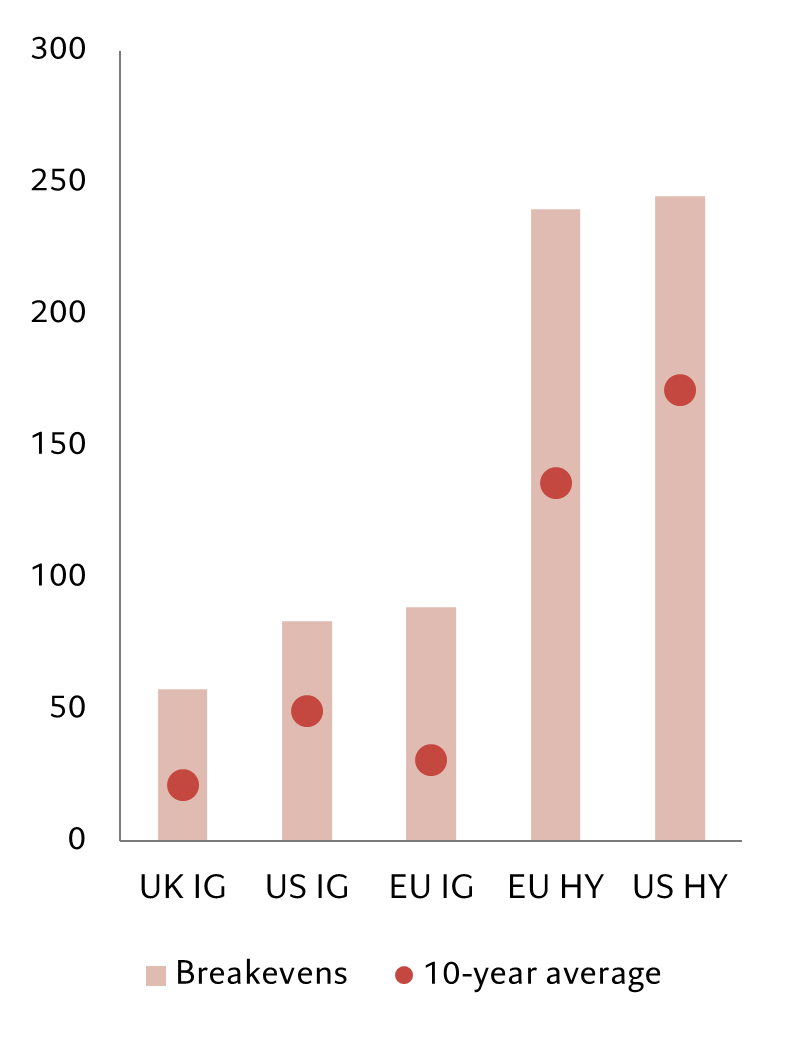

Even so, there’s potentially plenty on offer from credit and equities. Investors should be looking at assets which offer ample compensation against risks, a buffer against volatility. Right now, certain high yield credit and emerging markets offer significant protection against drawdowns (see Fig. 2). Short maturity investments avoid some of the risks of policy volatility. Overall breakeven yields – the level that yields need to rise before investors lose money – are among the highest in a decade.

And then there’s equity.

Equity market volatility has dropped even though valuations are relatively high – particularly in some sectors – and effective duration of these assets is long. Equities weathered the monetary policy tightening cycle better than bonds, to the surprise of many, because companies themselves are able to respond to changes in conditions. Corporate management can overhaul their business models and change their general approach as the economic environment shifts. It is telling that, even as corporate earnings suffered initially from rising inflation, they’ve made a rapid recovery since.

This resilience and the fact that most leading economies look set to skirt recession this year against a backdrop of falling interest rates should underpin equities and therefore investor returns.

If the past couple of years have shown anything, it’s that risk is impossible to avoid. Even money market instruments were shown to be vulnerable during the Lehman Brothers meltdown that triggered the global financial crisis of 2008. What investors need is a margin of safety, a cushion to keep them afloat through the market’s frequent rip tides. Across most risk preferences, investors would do better diversifying their portfolios across the markets’ capital structure than sitting on cash, thanks to the margin of safety on offer from current yields and spreads. Not only is cash not king, it could prove to be the joker in the pack.

Important legal information

The Pre-Contractual Templates (PCT) when applicable, the Key Information Document (KID), as well as the Prospectus must be read before any decision to invest. The Prospectus (in English and in French), the PCT when applicable, the KID (in French and in Dutch), as well as the latest annual and semi-annual reports (in English and French) are available free of charge at our financial Belgian agent CACEIS Belgium S.A., 86C /b320, Avenue du Port, 1000 Bruxelles or at the management company, Pictet Asset Management (Europe) SA, 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, as well as in digital format at www.assetmanagement.pictet.

The summary of investors rights is available here and in French and in Dutch at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The NAV are available at www.beama.be.

Claims and Mediation Service: For any claim you can contact Pictet Asset Management (Europe) S.A., Compliance Department, 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg or the Consumer Mediation Service (Service de Médiation pour le Consommateur), North Gate II, Boulevard du Roi Albert II 8 in 1000 Bruxelles or at www.mediationconsommateur.be. The Mediation Service may suggest solutions for the settlement of the dispute. In the absence of agreement on the proposed solutions, each party may bring proceedings before the competent courts.

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future.

Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

This marketing material is not intended to be a substitute for the fund’s full documentation or any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus.

The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.