Hedge funds: in search of alpha

Following a period of policy uncertainty, the path for global interest rates is now relatively clear. We believe that’s good news for alpha generation and particularly for hedge funds.

What does the current interest rate environment mean for hedge funds?

The global economy is about to enter a new phase of the interest rate cycle. Aggressive rate rises are behind us and most major central banks are setting out plans for looser monetary policy.

As the outlook for interest rates becomes clearer, there is greater dispersion in the returns of individual asset classes. This, in turn, increases the number of relative value opportunities that investors can capitalise on.

In addition, while rates are set to decline, they are still likely to remain elevated – certainly compared with the era of zero to negative levels that followed the global financial crisis (GFC). This will lead to greater differentiation between companies and, therefore, more investment opportunities for fundamental stock pickers. In fact, historically, periods with high interest rates (above 4 per cent), have been characterised by strong returns and alpha generation by hedge funds.1

With rates having peaked, companies will be more comfortable executing their longer-term strategy, leading to a gradual pick-up in public listings and mergers and acquisition (both of which have fallen sharply in recent years). Indeed, global M&A activity is forecast to increase by 50 per cent this year.2 This broadens the hunting field for hedge funds which can leverage such events to maximise returns.

For all these reasons, we believe that the prospects for alpha generation for fundamental investors are improving as markets become more sensitive to stock-specific factors rather than macro-economic shifts such as the path of interest rates.

While rates are still high, aren’t bonds still more attractive on a risk adjusted basis?

It’s true that, although rate cuts are coming, the reductions are unlikely to be aggressive or rushed. What is more, inflation could prove stickier than expected. Rates will therefore remain relatively high. You could argue that, while rates are high, it makes sense to invest in bonds, locking in the attractive yields still on offer with limited risk of those yields going up further (and thus of bond prices falling).

However, bonds aren’t the only instrument that benefits from elevated rates.

Higher short-term interest rates also support the absolute performance of long/short equity funds, particularly market neutral funds, whose short book is meaningful in order to achieve neutrality.

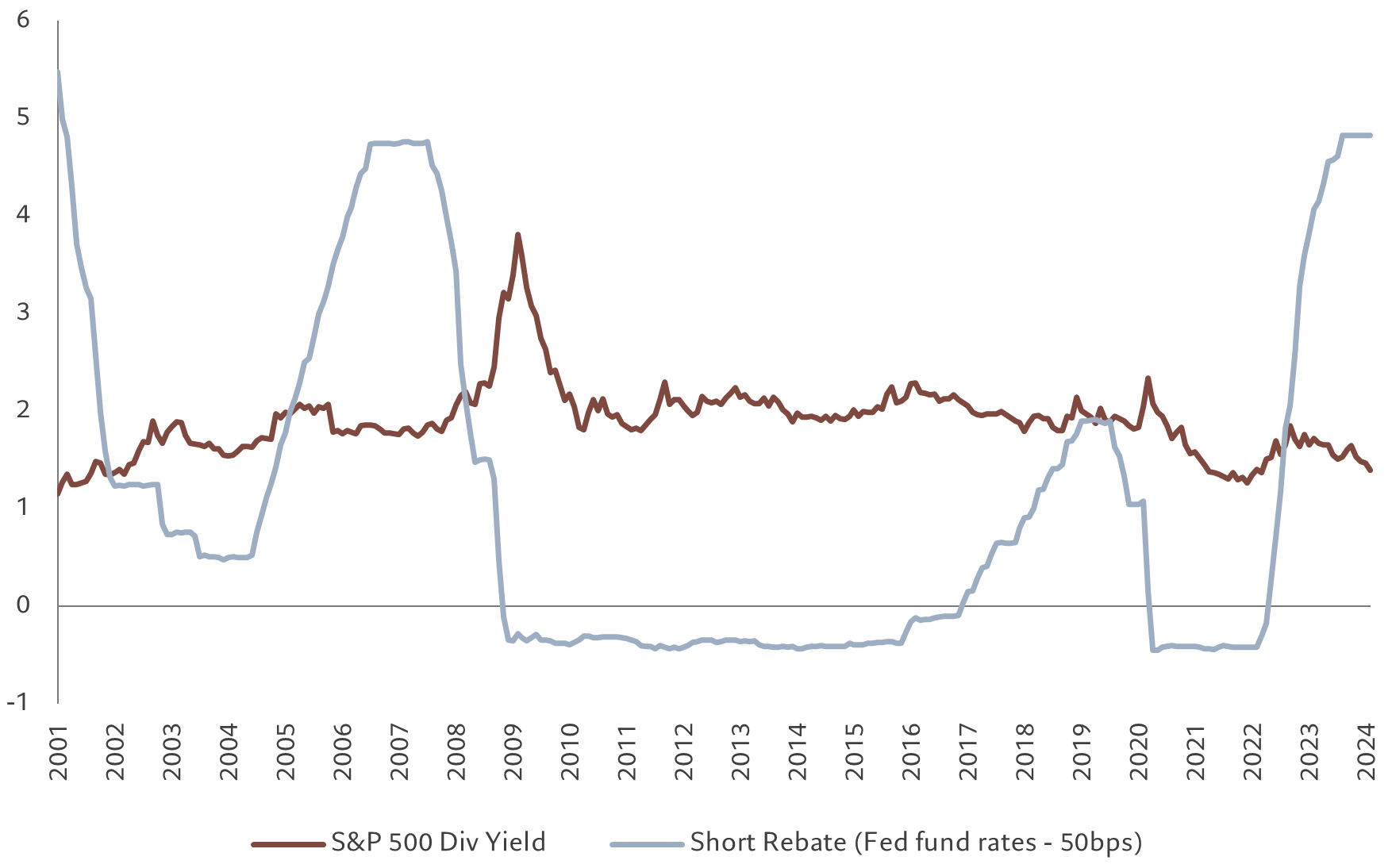

Why is that? When a hedge fund takes a short position, it borrows the security and provides cash collateral to the lender. During this borrowing period, the fund must pay the lender any dividends received on the stock, but it also earns interest on the cash collateral, known as the short rebate. Currently, short-term interest rates are at levels not seen since the GFC, resulting in significantly higher short rebates (see Fig. 1). The higher short rebate reduces the cost of carrying short positions which is now a structural tailwind for the absolute performance of these funds. In an environment which also favours alpha generation, this is effectively the cherry on the cake.

Source: Bloomberg, Pictet Asset Management. Data covering period: 31.12.2000-29.02.2024.

To simplify, a market neutral fund balances out long and short positions to achieve neutrality, which is broadly equivalent to holding its full value in cash (which earns the interest rate minus a spread) – only with the added benefit of possible additional and potentially significant returns from the underlying long and short positions (i.e. long/short performance spread or alpha).

The tailwind from the short rebate is just one of the reasons the coming months should be more favourable for relative hedge fund outperformance. As long as it doesn’t return to zero or negative, the rate environment will remain more supportive than it has been for the previous decade. Therefore market neutral strategies with a conservative risk return profile can complement a fixed income allocation, as they too mechanically benefit from higher rates.

In addition, the shape of the yield curve (both in the US and in Europe) means that hedge funds which see their large cash balances remunerated at the overnight interest rate are very well positioned relative to Treasury bonds from a yield perspective.

What benefits do hedge funds offer investors?

One of the key benefits is diversification.

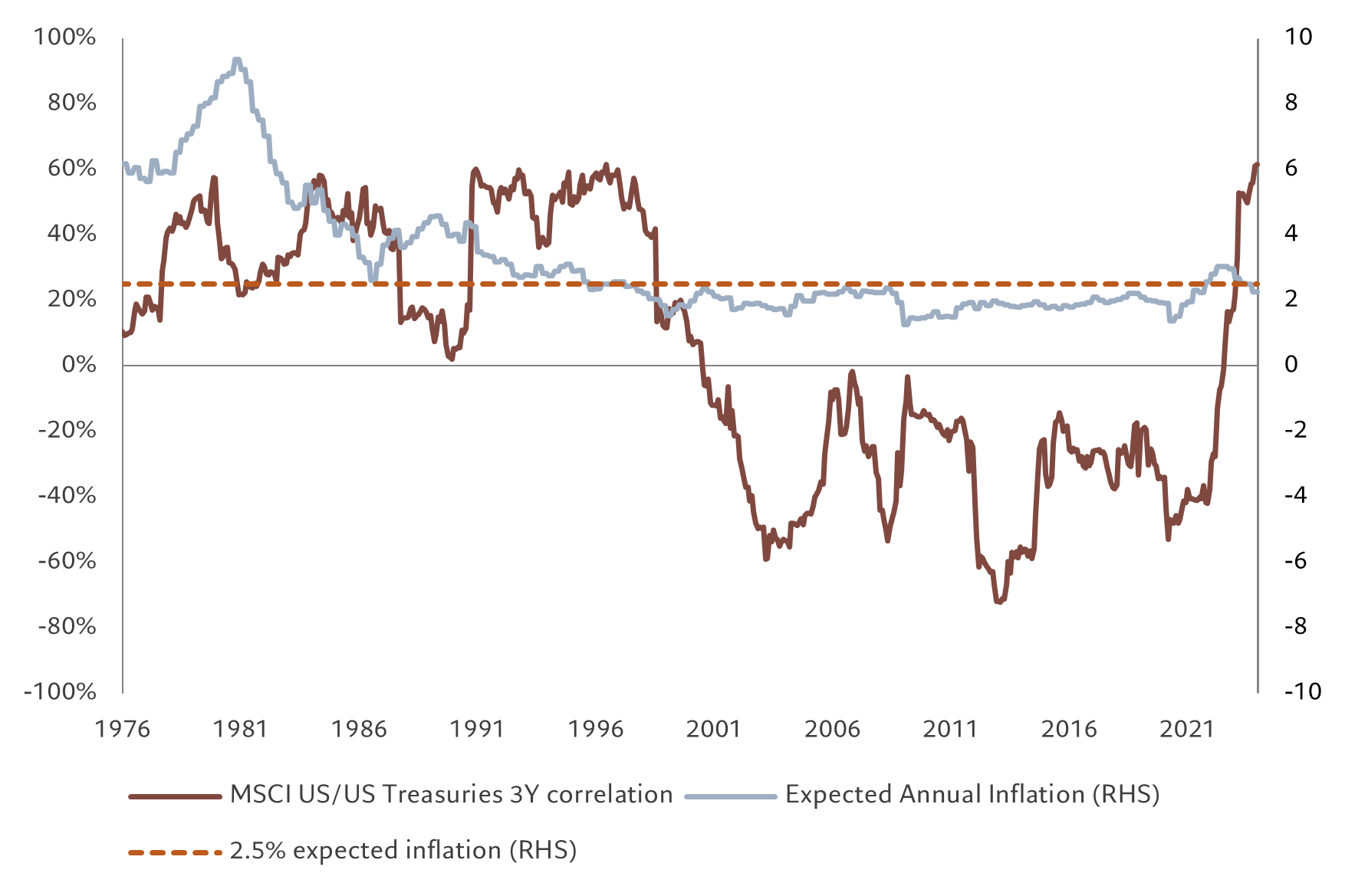

Traditionally, investors used to hedge against the underperformance of equities by allocating a portion of their money to bonds. More recent history shows that this strategy alone may not achieve sufficient diversification because the correlation between bonds and equities changes over time. It is not consistently negative and is very much influenced by expected inflation (see Fig. 2).

Source: Bloomberg, Refinitiv, Pictet Asset Management. Data covering period: 01.01.1976-29.12.2023.

Conversely, certain hedge fund strategies have a strong track record of performing independently of both equities and bonds.

The diversification benefits can be accessed in two main ways, depending on which type of hedge fund investors choose. Some serve as diversifiers because their returns show little or no correlation with those of equities and bonds. In this category we find multi-strategy and equity market neutral strategies.

Other strategies can serve as substitutes, capable of replacing a portion of equity investments in a portfolio and improving the risk return profile. Directional long/short equity funds fall in this category as they aim to offer returns similar to those of equity markets but with less volatility and limited drawdowns. Conservative equity market neutral funds or multi-strategy funds can also be used to improve the risk return profile of a bond allocation.

We are convinced that diversification will be a key consideration for investors in the years ahead, even more so than in the last 10 years (see our Secular outlook). Hedge funds, with their ability to decorrelate and protect the downside, will thus continue to play an important role in a global allocation.

How are your strategies capitalising on the opportunities?

Investing globally with no benchmark constraints allows investors to take advantage of the different stages of the business cycle across the globe through a mixture of long and short positions.

Today, for example, growth in Europe is subdued, and stock dispersion is high (underscored by the divergences of the recent earnings seasons). Such an environment tends to reward stock picking.

Asia is another region that offers a rich hunting ground for stock pickers.

For instance corporate governance reforms in Japan (including new rules on price/book ratios) are incentivising cash rich and unlevered companies to start or increase their dividend and buyback programmes. Shareholders are successfully lobbying companies to focus more on measures that can boost profitability, and we think that Japan is also uniquely placed to benefit from a boom of strategic activity via M&A, spin-offs, manager buyouts or joint ventures. Corporate reforms are incentivising companies to dispose of non-core subsidiaries, adding to an already favourable environment created by tax incentives, low interest rates and ample availability of private equity capital.

We also expect to see continued high levels of corporate activity in South East Asia and Australia. The former is benefiting from strong economic growth, capital flight away from China and an improving regulatory environment. The latter, meanwhile, is capitalising on its powerful position in the global commodity industry which is vital to the energy transition.

China is a market that investors have found challenging over the past three years, given deflationary pressures and property sector weakness. Yet, China still offers many bottom-up opportunities driven by changes in, for example, consumption habits and technology, and how well companies are adapting to these. We thus favour consumer companies that respond to more discerning and pragmatic consumers and have a tailwind from overseas growth, while we are cautious on industrial companies facing overcapacity and price pressures. We also remain positive on the semi and tech hardware sector in the region given the strong AI capex cycle in the coming years. Recently, several companies have moved to bolster shareholder returns by augmenting dividend payouts or implementing share buybacks. Following positive share price reactions, an increasing number of other businesses are now considering similar strategies.

Overall, we believe that changing market conditions mean that investors require a more agile approach to portfolio construction, and that the strategic case for hedge funds is as strong as it has ever been. As part of a diversified portfolio of stocks and bonds, hedge funds have the potential to improve the risk-adjusted returns over the economic cycle. Not only do hedge funds represent an increasingly attractive alternative to money market funds, whose popularity will gradually diminish as central banks cut rates, but they are also able to offer a degree of capital protection in the event of market volatility.

Independent and highly focused

We view our business as a collection of independent and highly focused teams of experts who can draw on Pictet AM’s global infrastructure.

Scale and experience

Managing USD7.7 billion in hedge funds assets across equities and fixed income. We employ more than 60 investment professionals, which are based in Geneva, London, Tokyo, Singapore, Hong Kong and New York.

Stringent on risks

A strong capital preservation culture, including prudent use of leverage and a focus on avoiding any liquidity mismatches.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.