Turkey: a canary in the emerging market coalmine?

Investors are concerned that Turkey's currency crisis could destabilise emerging markets and the world economy. That's unlikely.

Contagion thankfully doesn’t occur in financial markets too often. But that’s of little comfort to investors right now.

With Turkey teetering on the edge of the abyss, fears are that this erstwhile emerging market star could drag other countries down with it, tipping the world economy into recession and leaving its creditors in Europe dangerously exposed.

Yet what seems clear at first glance isn’t so obvious on closer inspection.

True, Turkey is in a dark place. Its huge foreign currency debts, widening current account deficit and soaring inflation – 16 per cent and rising – testify to a country flirting with a balance of payments crisis, one reminiscent of the sort that regularly roiled emerging markets in the 1980s and 1990s. The NATO member's spat with the US and its diplomatic overtures towards Russia and Iran threaten to make matters worse.

Nevertheless, it’s important not to overstate Turkey’s significance.

To begin with, its probable recession shouldn’t impact other economies directly.

Despite its close ties with the European Union, a population of 80 million and its decade-long growth spurt, Turkey remains a minor player on the world economic stage. It accounts for just 1 per cent of world GDP and only 2.8 per cent of the euro zone’s exports.

It's important not to overstate Turkey's significance... it accounts for just 1 per cent of world GDP.

A greater danger is the damage that might result from a wave of Turkish debt defaults. Turkey borrowed heavily over the past 10 years to finance its growth, mostly in foreign currency. Public and private debt has ballooned from less than 80 per cent of GDP in 2008 to over 100 per cent today. And a rising dollar and higher US interest rates make those debts more costly to service.

That’s a headache for European banks.

They were eager lenders, particularly Spanish and Italian institutions. Tellingly, that fact has not been lost on the European Central Bank, which has begun monitoring the region’s exposure to Turkey.

Still, here too, the risks look manageable. Spain’s banks are the most exposed but their lending to Turkey accounts for less than 5 per cent of their total foreign loans. Italy’s banks come a distant second, with Turkish lending accounting for just 1.9 per cent of their international claims.

Investor sentiment key

By far the easiest way for Turkey’s woes to spread to other markets is via a shift in market sentiment. There is always the temptation among investors to lump emerging nations together and dump their currencies and assets wholesale at the first signs of trouble.

That could happen – after all, Turkey was not the only country whose government and corporations took advantage when US rates were low to boost borrowing.

But dig a little deeper and it’s clear that the country is an emerging market outlier – just as it was during the attempted 2016 coup d’etat, when it was one of the few points of political turmoil in the emerging world.

Its troubling financial plight is far from representative.

The current account positions of developing economies, for instance, have in fact improved considerably since 2013. In aggregate, emerging markets’ current account surplus has grown from 0.1 per cent to 0.8 per cent of GDP over that time. Even among emerging countries with deficits, the gap has narrowed to 1.7 per cent of GDP compared to almost 4 per cent during the taper tantrum of 2013, when markets wobbled after the US Federal Reserve signalled its readiness to scale back quantitative easing.

The notion that emerging market companies are awash with debt doesn’t hold up to scrutiny, either. True, Chinese firms have been big borrowers, but strip them out of the analysis, and the picture isn’t quite so unsettling: company debt as a proportion of GDP in emerging markets drops from over 100 per cent to just 48 per cent, a mere 3 percentage points above where it was five years ago. That compares to 72 per cent for the US, 100 per cent for the euro zone and 103 per cent for Japan.

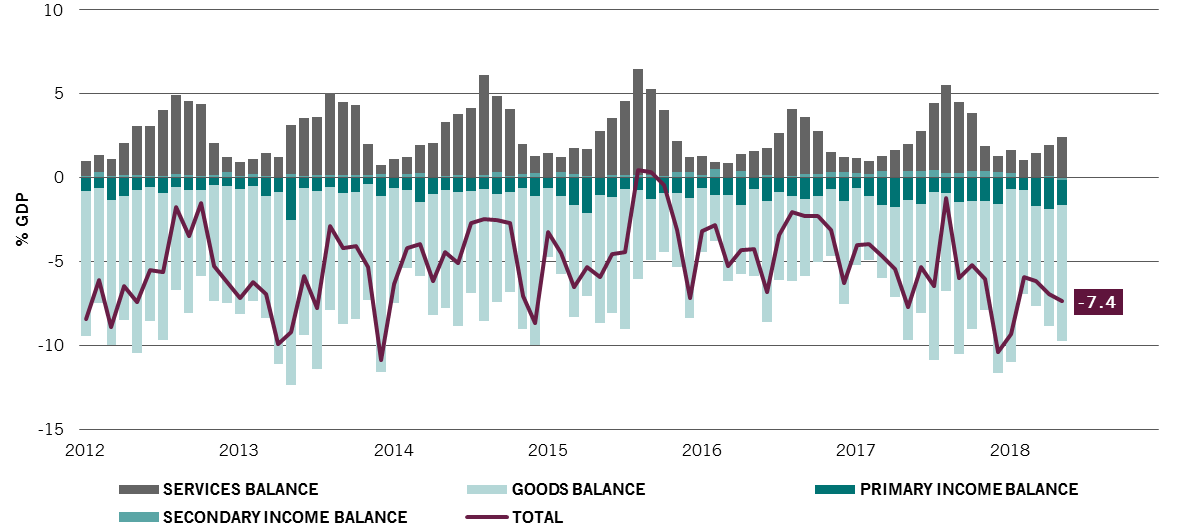

Breakdown of Turkey's current account, %, GDP

Also encouraging is that borrowing is moderating across the developing world, China included. The credit gap – or the difference between the current and trend rate of private debt growth measured as a proportion of GDP – has been falling across all major economies. In China, the differential has dropped from a peak of 27 per cent of GDP to 17 per cent. In Brazil, India, Russia and India, the gap has actually turned negative. What’s more, the proportion of “risky” corporate loans and bonds in the developing world (ex-China) is lower than it was during the 2008 financial crisis, according to a study by the Fed.1

In part, that’s because many of the firms issuing dollar-denominated bonds are exporters whose revenue is predominantly denominated in foreign currency. For these companies, when the greenback rises, the resulting increase in debt costs is offset by the extra revenue earned overseas.

What’s also been overlooked during this recent bout of turbulence is that increases in US interest rates aren’t necessarily bad news for emerging market assets or currencies.

As long as the Fed is tightening monetary policy in response to faster growth, the economic spill-over to the developing world should be positive. An analysis undertaken by Barclays bears this out. The bank found that in every US hiking cycle since the mid-1990s, emerging market currencies and bonds have tended to outperform developed world counterparts.2 The same picture emerges in our own study.

Of course, should the world descend into an all-out trade war, then global growth would deteriorate precipitously. But if, as we believe, the tariff disputes lead to improvements in how the world trading system functions, then the strong fundamentals of emerging markets should come to the fore. Turkey’s woes won’t alter that.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.