Maybe Brexit won’t break Britain (and the world)

The Pictet Strategy Unit looks at whether there could be a silver lining for investors to the surprise Brexit vote.

Will Brexit lead to contagion?

The British electorate’s decision to leave the European Union in the June referendum has roiled markets worldwide. It has clouded prospects for the UK and world economies, and threatens the future of the European project. Investors are obviously right to feel concerned. But they should also know that there are some silver linings to the Brexit clouds. And these could support riskier asset classes over the medium term.

The referendum might convince the German government to relent on some austerity demands on peripheral countries.

The biggest worry is that the UK’s looming divorce from the EU will encourage other electorates in Europe to demand their own ‘leave or remain’ referenda. After all, populist, anti-EU movements are gaining strength in France, Italy, Sweden and even Germany.

Yet there are reasons to believe that the EU’s key decision-makers, who are clearly aware of popular discontent with mainstream politics, might see fit to moderate some of the conditions that have heaped pain on the populations of weaker member countries.

The European Commission has already turned a blind eye to fiscal slippage in countries like Italy, Spain and France. So the UK referendum might yet convince the German government to relent on some of its austerity demands on peripheral countries. There could even be scope for officially-sanctioned fiscal easing as a way of mitigating Brexit’s impact.

Italy and Spain implications

Spain’s general election result is also cause for mild optimism. The vote, which followed soon after the British referendum and in which mainstream political parties did much better than expected, suggests Brexit might well make restive electorates a little less prone to rebellion.

How will the UK economy fare?

As for the UK, while we expect Brexit to have a negative impact on growth, possibly dragging the economy into a recession, the fallout could well prove less severe than some think over the long run. For one thing, UK-EU negotiations over a new trading relationship might not result in an acrimonious split.

Indeed, some commentators think Article 50, which lays out the process that would ultimately lead to Britain’s withdrawal from the EU, might never be invoked.

What’s more, a new UK government, expected to be in place by September/October, could well provide significant fiscal stimulus, say, by quickly approving major infrastructure projects, or by implementing pro-business policies (a cut in corporate tax rates, for example), as a way of supporting the economy.

At the same time, major central banks are likely to offer support where needed. The Bank of England has plenty of ammunition at its disposal – it could cut rates or restart Quantitative Easing, though sterling’s fall will also be very stimulative for exporters.

The European Central Bank, meanwhile, could trim rates at the margin or announce an extension of its asset purchase programme.

How will the Fed react?

Most important of all will be the US Federal Reserve’s response. Only recently there were expectations that the Fed would hike its funds rate twice this year, by half a percentage point in total. Now, the market is forecasting no move until 2018. That may place a break on the appreciation of the US dollar, which would help export dependent emerging markets.

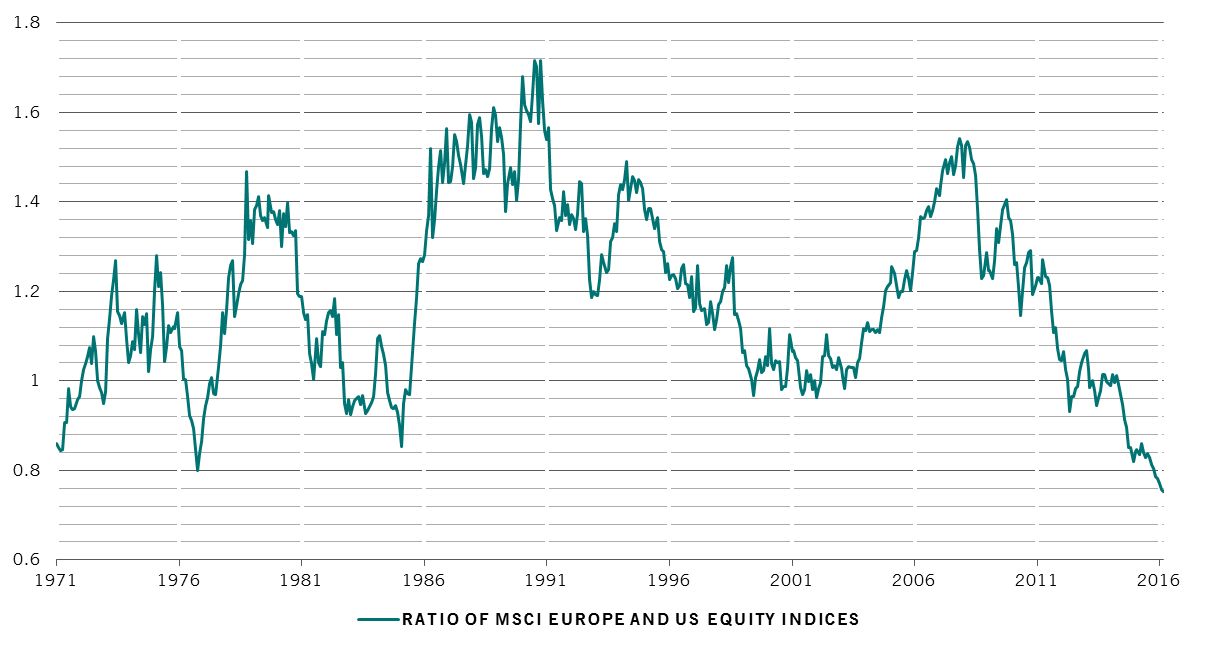

European equities could rally strongly if there's a move back into riskier asset classes.

Even before their post-Brexit selloff, European equities were at their cheapest valuations relative to the US since at least the mid-1990s. They could rally strongly if there’s a move back into riskier asset classes once the dust settles.

Clearly, Brexit is a reminder investors have to start paying more attention to political risks. US elections this autumn, French and German ones next year each have the capacity to reignite market turmoil. But investors shouldn’t only discount worst case outcomes.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.