Emerging markets: the back door to AI investments

US tech firms Nvidia and Microsoft have understandably become AI darlings. But investors looking to capitalise on advances in machine learning should also take a close look at emerging markets.

In the 12-months since Chat-GPT was launched, investors have thrown themselves headlong into artificial intelligence (AI) stocks. Or, more precisely, into US-listed AI stocks.

Because, while Nvidia, which makes the chips that train AI computers, has soared 250 per cent over that period and US tech giants Microsoft and Meta have also experienced dizzying rallies, non-American firms key to the development of machine learning have been left trailing. Among the overlooked is a large group of Asian companies crucial to the AI supply chain. Increasingly, they represent a missed investment opportunity.

That’s not to say it is wrong to regard US technology companies as the main beneficiaries of the latest advances in AI. They undoubtedly have the expertise, experience and financial firepower to transform the new technology into a huge commercial success.

The issue is that investors cannot afford to be complacent about the valuations these firms now command. There is a lot of future growth baked into those stock prices after all. All of which means that anyone looking to capitalise on the unfolding AI revolution will soon have to look beyond the increasingly expensive US tech sector.

Alternatives to Nvidia, Meta and co. abound. Yet perhaps the most promising source of investment returns are AI-related companies based in emerging Asia. These are the 40 or so listed businesses operating out of countries such as Taiwan, South Korea, China that manufacture almost all of the world’s AI chips and many of the AI-enabled products that are essential to the growth of the technology; they are providing the picks and shovels in this AI goldrush.

The AI investment opportunities we have identified fall into three categories.

To begin with, there are the companies that form part of the graphic processing unit (GPU) supply chain. These are the firms facilitating – and benefiting from – the growth of Nvidia’s specialist AI chips. In fact, all of Nvidia’s AI processors are produced, packaged and embedded into servers by Taiwan-based companies. As it boosts the processing power and memory of its AI chips, Nvidia will increasingly rely on, among other things, the sophisticated processor packaging technology – known as chip-on-wafer-on-substrate, or CoWos - that has been honed by Taiwan’s largest semiconductor group, TSMC.

Another hunting ground for AI-oriented investors is to be found among the companies that manufacture cheaper AI chips for Nvidia’s US competitors including Microsoft and Amazon’s own chip unit. The high prices that Nvidia’s processors command – and the limited supply of such products – are opening up opportunities for rival, low cost producers.

Among the most promising alternatives to Nvidia’s GPUs are processors known as Application Specific Integrated Circuits (ASIC). While high-end computing still requires GPUs, ASIC-powered servers can be deployed in other areas of AI development such as model inferencing, the process through which a trained AI model infers results from the analysis of live data. ASICs offer cost savings of around 10-20 per cent compared with Nvidia's AI servers. Delivery times are shorter too. Companies that specialise in the production of ASIC chips include Taiwan’s Alchip and Wiwynn.

The third group of investment opportunities are Asian manufacturers of AI-enabled hardware.

The launch of a new breed of AI-enhanced smartphones and personal computers is expected to usher in an personal tech replacement cycle that could disproportionately benefit Asia-based hardware firms. According to some analysts, the growth in unit sales of AI enabled phones could increase at a compounded annual growth rate of some 80 per cent through to 2027 (see Fig 2).

AI’s expansion is already providing a significant boost to the revenues of tech companies in emerging Asia. TSMC's AI-related revenue, for example, is expected to more than double to over 10 per cent of the group total in 2024 while its Taiwan-based competitor Wiwynn's AI ASIC revenue is projected to increase from less than 10 per cent of its total to more than 30 per cent in 2024.

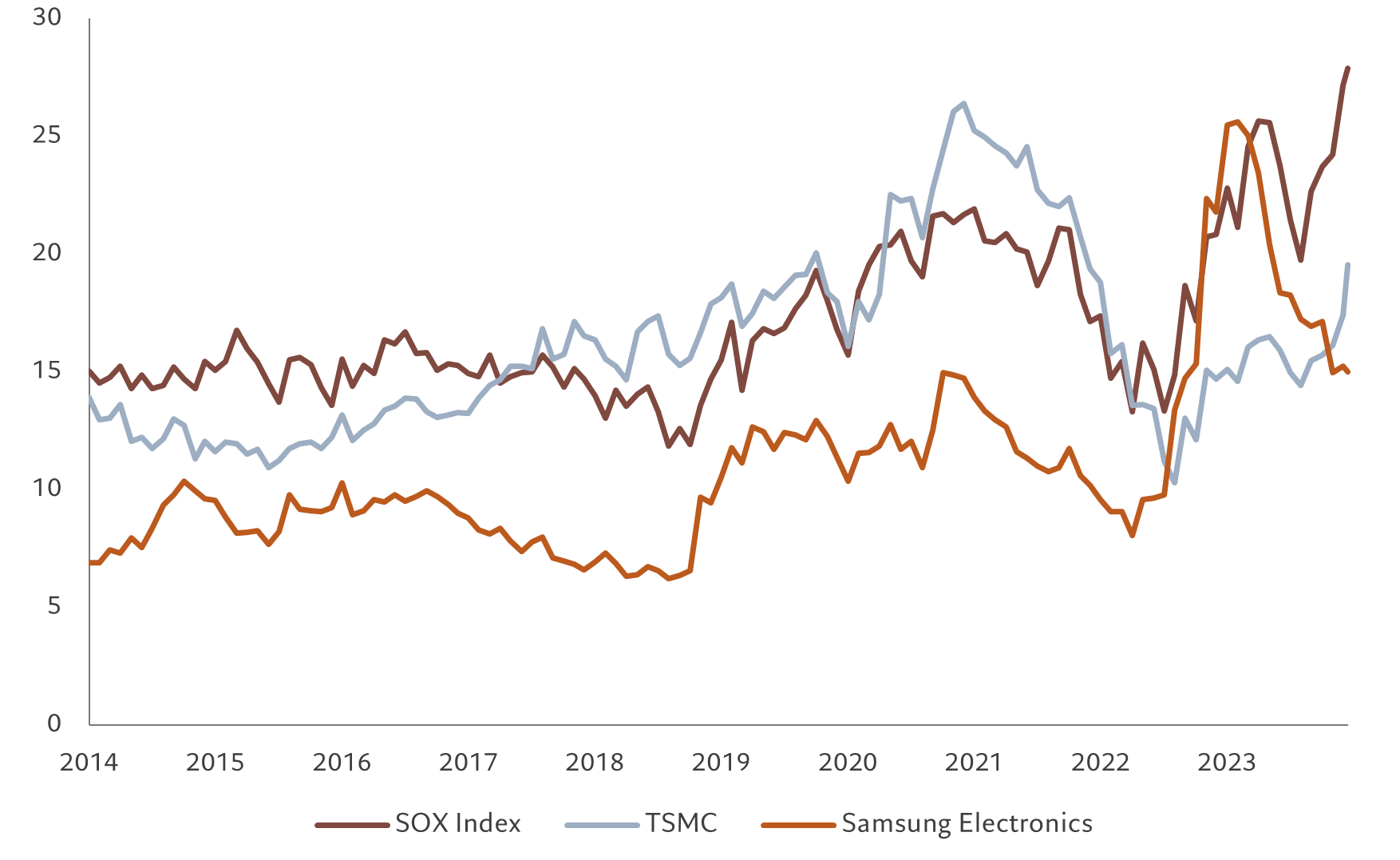

Crucially for investors, these companies trade at far lower valuations than the US’s AI behemoths. By our calculations, the median price-earnings ratio for the companies that make up the EM AI supply chain is 19.2, offering a considerable discount to US semiconductor stocks, which trade at some 27 times 12-month forward earnings.

Strong fundamentals in EM AI supply chain

Moreover, their earnings and sales prospects are also solid: the median market forecast points to annual revenue and profit growth of 14 per cent and 26 per cent respectively.

The upshot to all this is that investors have several options through which to capitalise on the advance of AI. While the US technology sector is clearly one of them, the eyewatering rally enjoyed by stocks such as Nvidia suggest investors may soon need to look at cheaper alternatives.

Emerging Asian tech companies are among the most promising.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.