China's fibre diet

China’s environmentalism was a key focus of the pulp and paper industry’s recent conference in Shanghai in which Pictet Asset Management’s Timber Advisory Board participated.

China’s new-found environmentalism is having an impact far beyond its borders – not least in the global pulp and paper industry.

The government’s efforts to switch energy production from dirty sources like coal are likely to affect saw mills and pulp producers, which are energy-intensive. Likewise with water. Official concerns about excess water use are forcing mills to either keep consumption down or close. Already, over the past five years more than 1,000 smaller pulp and paper mills have been shuttered, with more to come. As a result, the sector is likely to consolidate into bigger, more modern plants.

But Beijing has also taken more direct measures. For example, the Chinese government’s new anti-pollution efforts include a ban on imports of mixed waste and increased standards for the quality of recycled paper its willing to accept from abroad. That matters because recycled paper products have been a major source of fibre for Chinese containerboard and cartonboard production, which in turn is essential to the global packaging industry.

The measures are likely to have a major impact on both the domestic and global markets for fibre. In 2017, around a third of all the recycled paper used by Chinese producers was imported. But the new government measures mean that Chinese industry faces an 8 million tonne shortfall in 2018, equivalent to 10 per cent of the previous year’s total demand for recovered paper.

The market for fibre is coming under additional strain from rising demand, not least as environmental considerations and rising oil prices encourage a shift away from plastic packaging. Ever more of that gap will be filled by wood and paper products.

The simultaneous squeeze in both supply and demand is pushing Chinese fibre prices up. In 2017, the price of domestic recovered cardboard, a major source of paper fibre, jumped by 80 per cent, while at the same time the price of imported mixed waste slumped by 30 per cent.

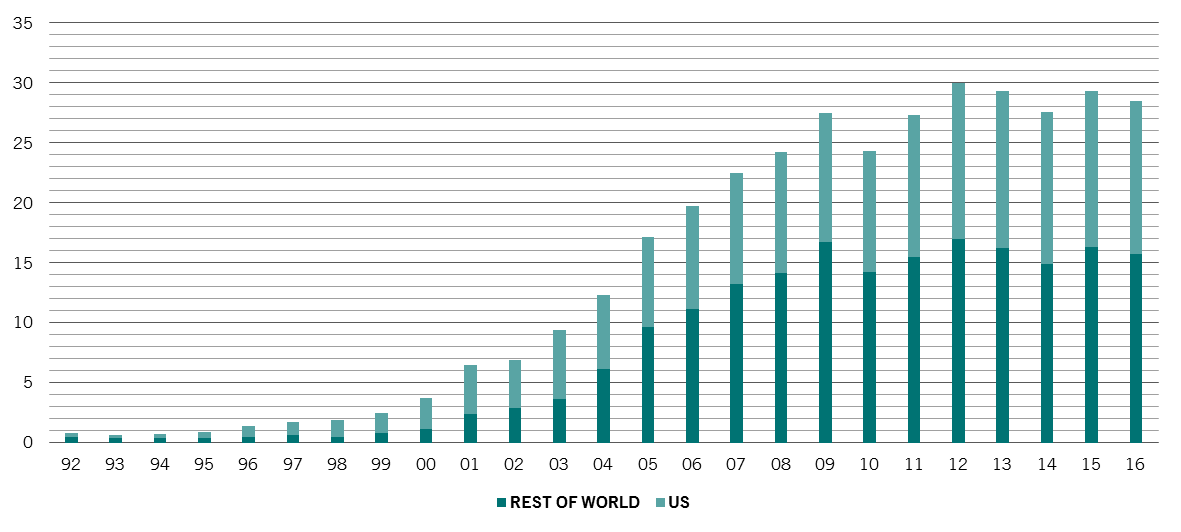

China paper and paperboard waste and scrap imports (m metric tonnes)

Source: UN Comtrade. Data as at 01.07.2018

Meanwhile, countries that had exported their paper and mixed-waste to China now have to find something else to do with this surplus. For instance, in the US, mixed waste prices effectively declined to nil, as collectors could not sell inventory and faced a cost for domestic disposal.

Greater concentration in the US recycling industry now looks likely – not least because the US is one of the world’s biggest exporters of recovered paper. China's actions are also bound to make users of paper packaging, particularly e-commerce companies, rethink how they operate. One potential change is for them to start picking up and recycling the boxes they use to deliver goods.

Investors need to be prepared for the impact of China’s environmentalism. In the pulp and paper industry, that means favouring leading companies with Western-quality operating standards. At the same time, Beijing's increasingly tight standards for imports of recycled fibre will reward US firms that have the ability to handle waste paper with the minimum of environmental impact. A consequence of falling sales of recycled fibre to China will be falling prices elsewhere, potentially encouraging demand for the now-cheaper recycled fibre from elsewhere.

High and rising demand for containerboard and boxes in China could drive up costs that are likely to be passed on to consumers. Finally, restrictions on fibre imports are likely to boost Chinese demand for virgin pulp from countries like Brazil.

The pulp and paper industry could prove to be a barometer of China’s commitment to environmentalism – and show quite how global these efforts can be.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.