Why yield curve control should be Draghi’s parting shot

The euro zone should adopt a radical Japanese style monetary policy if it wants to avoid Japanification.

A Japanese rabbit for Mario Draghi?

The European Central Bank chief should be paying particularly close attention to his Japanese fellow central bankers.

That’s because the eurozone, with its multi-speed economy, needs a radical, Japan-style “yield curve control” policy (YCC) almost as much as Japan does. It should be the last rabbit he pulls from his hat before stepping down later this year.

Japan has been the global vanguard for unorthodox monetary policymaking. Its experiments with helicopter money in the 1930s and, more recently, with quantitative easing and negative interest rates, have offered other central banks valuable lessons.

Thanks to its YCC policy, the Bank of Japan is once again in its counterparts’ sights as monetary authorities search for ways to reduce stimulus without endangering growth.

To understand why, it’s important to look how and why the policy works.

Under YCC, the BOJ undertakes bond purchases with specific aims of maintaining short-term rates at minus 0.1 per cent and 10-year government bond yields at zero per cent.

This policy’s chief attraction is that it has served as a “stealth” tapering of QE. The BOJ has managed to reduce its annual bond purchases by JPY60 trillion to 20 trillion without disrupting financial markets.

It has thus been able to avoid a repeat of the US taper tantrum in 2013, when bond yields surged after the Federal Reserve announced plans to retrench from QE.

YCC’s other great success has been in helping Japan start to grow out of debt by keeping its borrowing costs below the level of its nominal economic growth, a key element of what Bridgewater’s Ray Dalio calls a “beautiful deleveraging”.

From this perspective, YCC is beneficial to the eurozone, or at least some parts of it. This is especially true for Italy, whose public debt burden of 130 per cent of GDP, the region’s second highest after Greece, is far from sustainable.

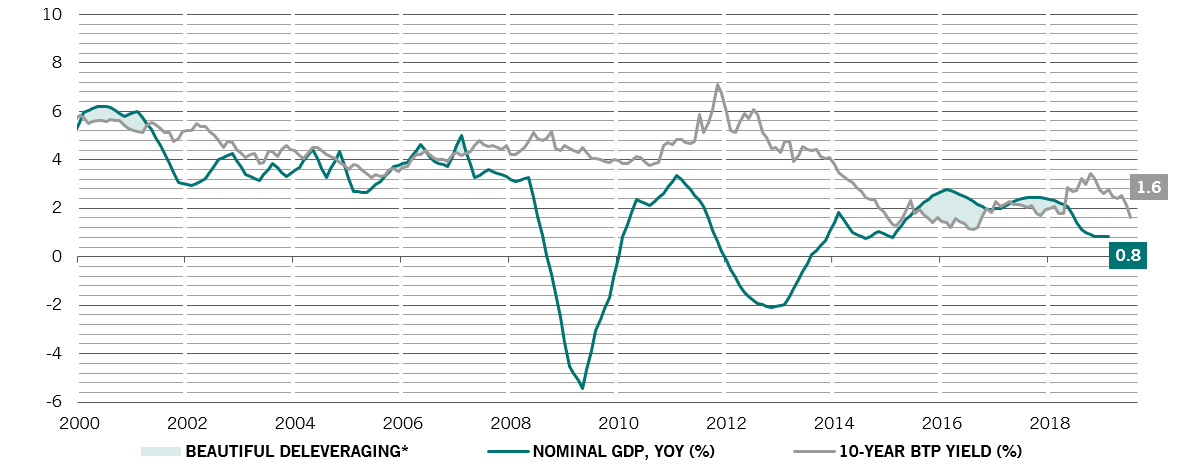

The country’s interest payments amount to 4 per cent of GDP, four times those of Germany and double the OECD average. Moreover, its debt servicing costs are 0.9 percentage points above its nominal GDP growth rate (see chart).

Italy's nominal GDP rate vs 10-year bond yield

In another parallel with Japan, the eurozone periphery is struggling to boost private lending. Without the ECB operating the printing press, the economic recovery in southern Europe, where credit is still contracting, could soon fizzle out.

For a region where some countries require monetary tightening and others stimulus, a US-style exit from ultra-loose policy could prove damaging.

A European YCC, by contrast, would provide targeted support to the continent’s south.

In practice, the ECB could introduce a cap of, say, 0.5 per cent for eurozone 10-year debt. While it represents a sharp adjustment, it should help close the gap between Italy’s benchmark borrowing costs and its nominal GDP rate, which will help the country reduce debt relative to the size of its economy.

YCC could also ease the strain on eurozone banks, which not only own large amounts of government bonds but are also struggling to shed nearly EUR800 billion of non-performing debt.

The policy would, for instance, lift the pressure on Italian banks, which collectively hold 28 per cent of domestic sovereign debt and struggle with a pile of soured loans.

All this is not to say YCC would be an easy sell. Because the cost of debt would be suppressed, governments may be tempted to borrow more. To prevent potentially reckless borrowing and assuage the concerns of fiscal hawks such as Germany, the ECB could make the yield cap conditional on predefined fiscal discipline targets.

In theory, YCC commits a central bank to buying a potentially unlimited amount of debt. But in practice, as Japan shows, the ECB’s overall bond purchases should gradually fall without an explicit tapering programme.

The ECB would have to be prepared to defend its yield targets as vigorously as the BOJ, which has carried out “infinite bond tenders” only a handful of times since the inception of the scheme to keep rates from rising during bond market sell-offs.

That shouldn’t pose too much of a problem, though. The ECB has proved both flexible and credible, benefiting from a rigorous institutional framework that guards its political independence.

YCC could prove a practical solution to the conundrum facing Draghi. It could — and indeed should — be his parting shot.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.