A niche opportunity

Small companies are the lifeblood of the European economy. The region is home to some 23 million small and medium-sized enterprises (SMEs), providing nearly two-thirds of its jobs and adding EUR3.4 trillion of economic value a year1. For those that are able to invest in alternative assets, the dynamism of such businesses makes for a potentially attractive investment opportunity. That has been especially true for private equity in recent years but in this new era of higher rates, higher inflation and low to negative earnings growth it should be credit’s turn to shine.

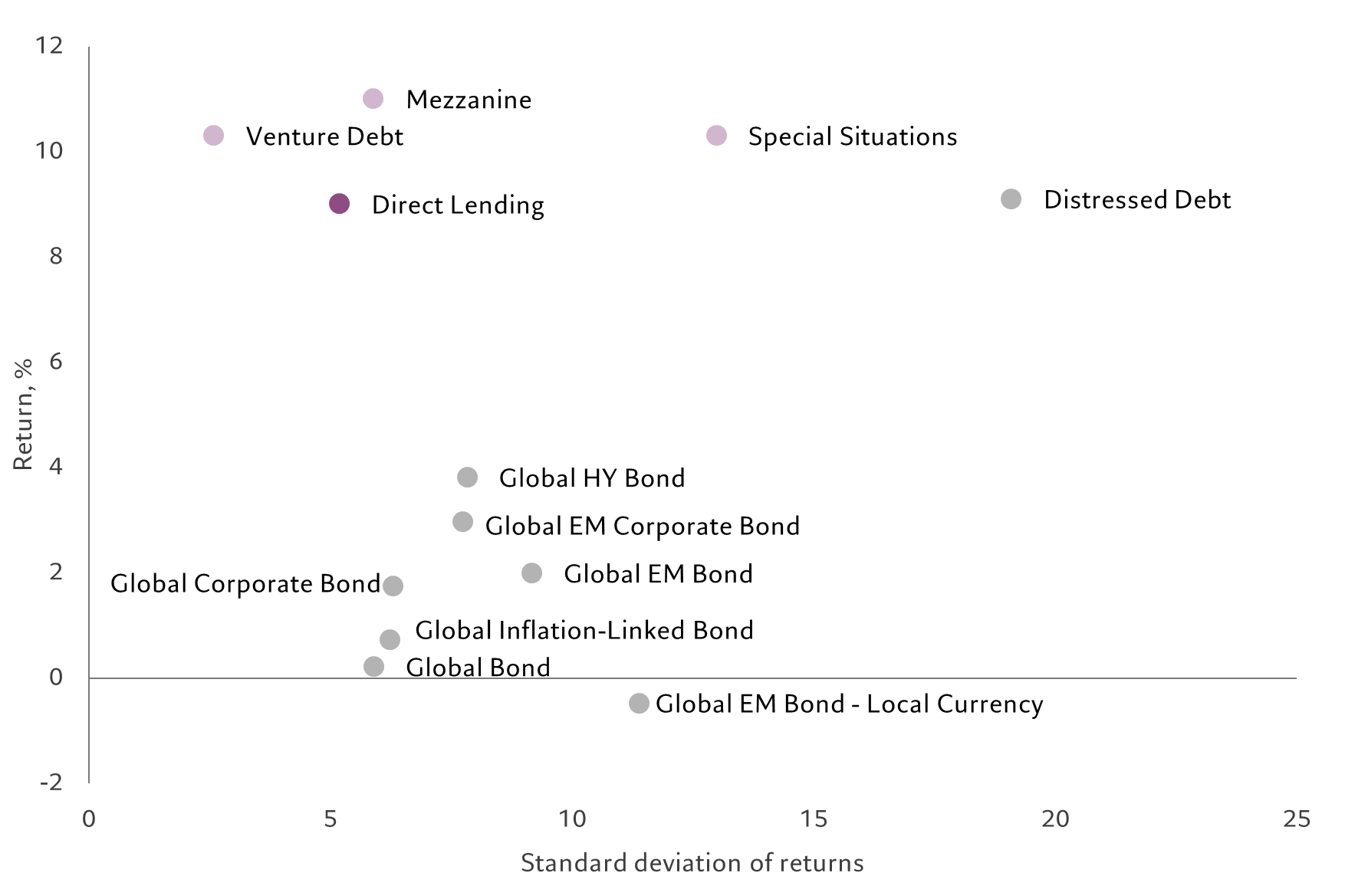

Yet, for investors in private debt (direct lending), smaller and medium-sized companies curiously do not form part of the investment universe. Due to economies of scale and the fee benefits, most private debt funds prefer to lend to larger companies – where deal tickets are bigger, but where competition is also much fiercer. We believe this is a missed opportunity as the commercial effervescence of Europe's small and medium-sized businesses is impossible to ignore.

A common refrain is that lending directly to smaller companies is a high risk and complex endeavour, requiring greater due diligence. There is some truth to this but the rewards on offer more than offset those risks, many of which can be controlled in any case. Many smaller companies are disruptive in the niches in which they operate, offering significant potential for development and growth above and beyond their more mainstream, publicly-listed peers. Our approach at Pictet Asset Management is to invest in businesses that have reached a crucial stage in their evolution, providing what we would describe as bespoke growth capital to allow them to reach their next milestone in their lifecycle.

Whatever the size of the deal under consideration, however, each potential investment requires thorough due diligence. Complicating matters is the fact that smaller companies often have less established reporting processes and information systems, requiring the funds to roll up their sleeves and put in the hard work.

Therein, though, lies the opportunity. An investor with the skill and capacity to carry out the necessary due diligence on smaller firms can unearth investment opportunities that most others would overlook due to the amount of work involved. These are the types of investment we are targeting in our private debt strategy.