AI and quantitative investing: the beginning of a beautiful friendship?

Generative AI and ChatGPT have captured the public imagination. Asset managers have been watching developments closely too.

Machine learning (ML) is being hailed as a better way to pick stocks. Yet in practice, the benefits of using ML and artificial intelligence (AI) in portfolio construction will manifest themselves in several different ways. The arrival of AI is, in our view, simply the latest phase in the long evolution of quantitative investing. What we might call Quant 2.0.

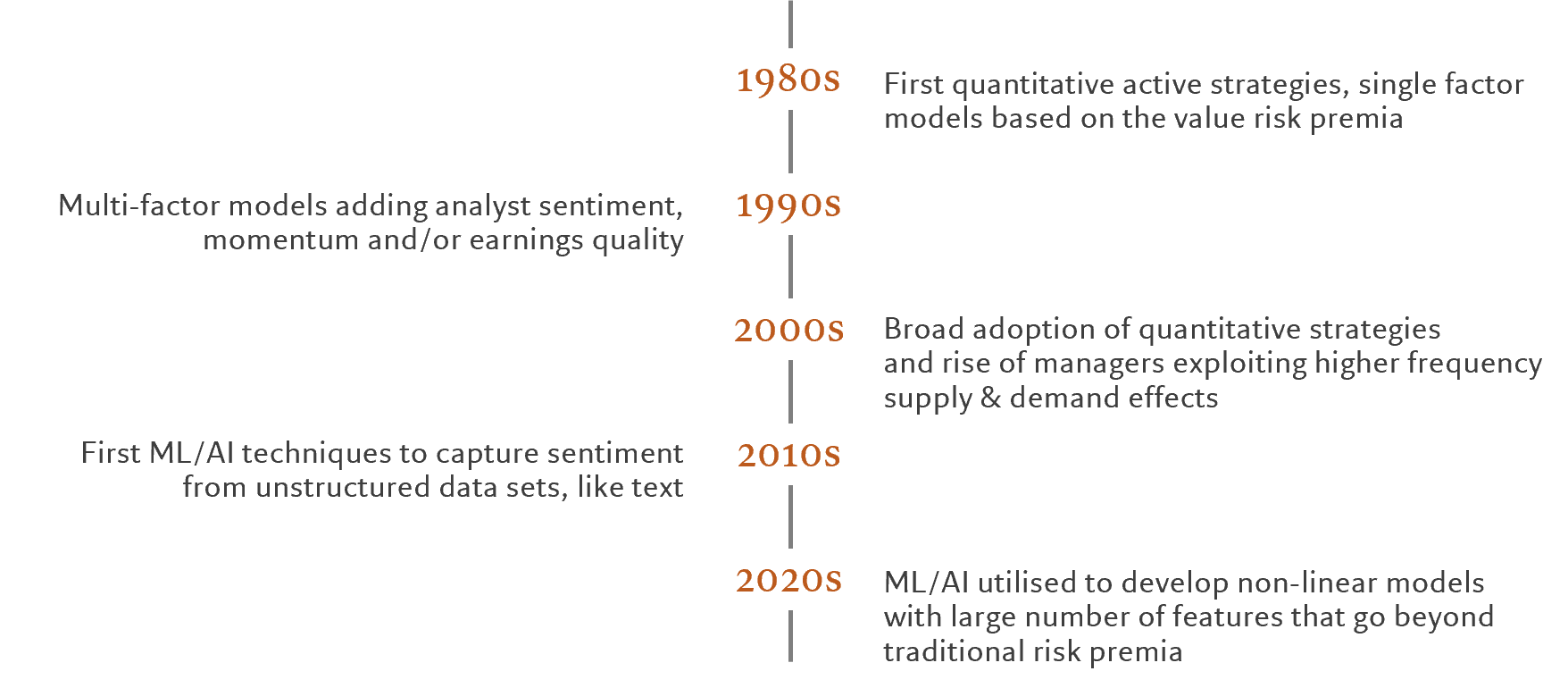

It was in the 1980s that quantitative portfolio managers first began using algorithms to select investments and manage risk. Those simple single factor models – which were used to identify risk premia - soon evolved into more sophisticated multi-factor systems that analysed phenomena as wide ranging as changes in analyst sentiment, investor positioning and the stability of corporate earnings. Today, quantitative investors work with a rich variety of machine learning based systems. There’s no doubt that this powerful new tech needs to be deployed further.

Artificial intelligence applications within a portfolio

The digitalisation of the world economy has led to an explosion in available data, both the structured kind – such as financial data reported by corporations - and the unstructured kind such as text, video files and images. How to analyse and combine this data using ever larger models is proving to be both a major challenge and an opportunity for quantitative portfolio managers.

AI helps on several fronts:

- Artificial intelligence can be used to extract signals and patterns from varied data sources

AI based on natural language processing (NLP), for example, can be used to analyse sentiment towards companies within news articles, sell-side analyst reports or earnings call transcripts. This is especially useful for quantitative portfolio managers who, unlike company analysts, often do not have meetings company executive and therefore risk missing out on ‘softer’ signals that can have a bearing on stock performance. Deployed well, we believe NLP techniques used to analyse earnings call transcripts can often identify relevant information not contained within the official earnings release. -

Artificial intelligence can enable more accurate investment forecasts

Our conviction is that advances in AI allows for more accurate forecasts for individual stocks than traditional factor investing. Traditional factor investing is designed to exploit risk premia – investment signals that are grounded in economic theory and backed up by empirical research. Aided by advanced AI, Quant 2.0 enables portfolio managers to identify anomalies that extend beyond these premia. These anomalies will often be found over shorter time horizons of, say, less than a month, a period in which investors’ positioning and market activity has a more powerful influence on stock returns than macro-economic forces or company fundamentals. Varied data sources can often offer a guide to changing behaviour. AI enables the combination of hundreds of features, thereby allowing quantitative investors to capture the relationships and interactions between the data to make more accurate forecasts. -

Artificial intelligence applications go way beyond stock selection

The new machine learning can be applied beyond stock selection, incorporating multiple time horizons with the aim of controlling portfolio risk, lowering trading executions costs and to optimise portfolio positioning. This is further developed in a research paper published in Quantitative Finance by our quantitative investment manager Thibault Jaisson, Deep differentiable reinforcement learning and optimal trading.

Transparency is key when using machine learning to invest

Many recent research papers have attested to the superior stock return predicting power of ML models.

But, in practice, employing AI-based models in investment is fraught with complexity and risk. The assumption that investors can accept AI as a black box no longer holds. There is a need to decompose features, positions, risks and performance of the underlying inputs. Transparency is crucial, which our quantitative team deeply looked into in another paper called Performance attribution of machine learning methods for stock returns prediction published in The Journal of Finance and Data Science.

What did our own returns decomposition analysis find?

First, that a part of the excess return from AI-driven models comes from strategies such as ‘reversal’, namely those stocks that, because of a particular return pattern, are likely to reverse direction. Or ‘short-term momentum’, stocks that will continue on their present trajectory. These are strategies that are employed by statistical arbitrage managers in traditional models.

Another part of the excess return comes from having a much larger number of features than can be effectively utilised in traditional quantitative models. Traditional models typically analyse tens of such features. Yet AI-powered ones can process hundreds of them and are also able to allocate greater weight to the features that have the highest positive impact on returns.

The final portion of the excess return stems from the interaction effects between the features that form part of the analysis. For example, stocks that enjoy positive analyst sentiment and low short interest – where only very few hedge funds hold a short position in it – will behave differently to stocks for which the opposite applies.Human judgement is still essential in deployment of artificial intelligence

Creating an ML model that is reliable, fast, accurate, and that can be continuously monitored and adapted over time is complicated and time consuming. ML models rely on a large amount of data, which makes it difficult for individual portfolio managers and analysts to monitor.One portfolio manager is not enough. You need a robust platform to use AI when investing

AI models:

- Require managers to make several adjustments, and as small changes can lead to enormous differences in the results, such changes need to be constantly evaluated.

- Rely on real-world data for predictions, so as real-world data changes, so should the model. This means that we, as portfolio managers, have to keep track of new data changes and make sure the model learns accordingly.

To overcome these challenges, a robust AI Operations platform is essential. This should be equipped with specific tools that ensure reproducibility, version control, scalability, and compliance.

The deployment of AI in portfolio construction requires a seamless collaboration between engineers, data scientists and portfolio managers, all of which aimed at creating a transparent decision making process capable of delivering alpha.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.