Direct lending in times of uncertainty

It might seem a harsh economic environment for lenders, but not for those providing direct loans. We believe reduced competition from the banking sector, the ability to select from companies with strong balance sheets, and high yields make this a very appealing entry point.

Rising interest rates, higher inflation and lacklustre economic growth may not sound like ideal investment conditions. But for private debt – lending directly to businesses - the climate is more favourable than it first appears.

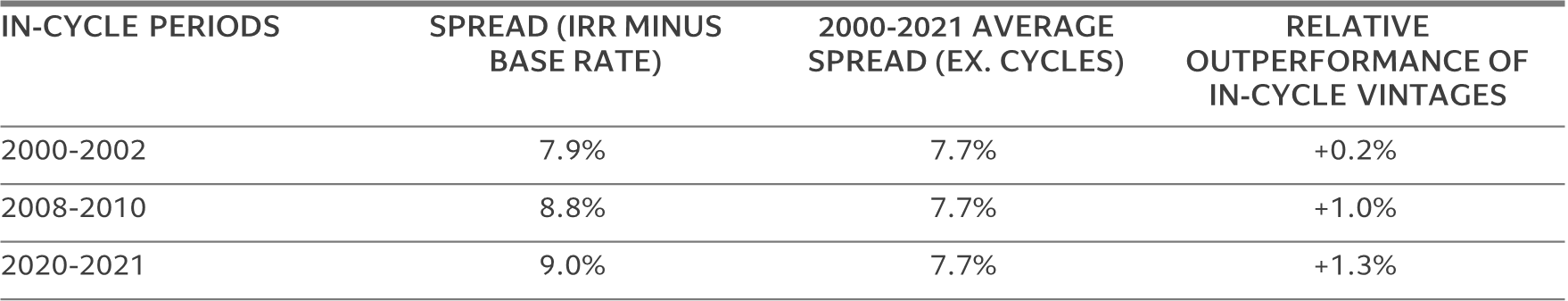

An analysis of investment returns covering business cycles of the past 20 years supports our thesis. Direct lending strategies launched during difficult economic times – known as “in-cycle" vintages – have delivered above-average returns (see Fig. 1).

There are several reasons why that has been the case.

First, when interest rates are elevated and the economy is slowing, investors find they can make loans on more favourable terms.

Second, as credit conditions tighten, companies respond by strengthening their balance sheets – which ultimately reduces risks for lenders.

Third, loans made during periods of economic uncertainty tend to have enhanced lender protections attached.

Stronger terms, defensive sectors

All of these factors apply today.

To begin with, the rates on offer for investors have indeed risen. Yields on European loans are now coming in north of 12 per cent, compared to 7 per cent last year.

That is primarily because private loans tend to be variable rate, with the cash coupon typically resetting every 30 to 90 days – a valuable feature at a time when European base rates are likely to stay higher for longer.

Secondly, companies that are seeking direct loans are, by and large, more financially disciplined than has historically been the case.

Today, there are many companies operating in Europe with relatively conservative balance sheets, or debt-to-EBITDA (earnings before interest, tax, depreciation and amortisation) multiples of around 2-3 times. That is a marked improvement on what direct lenders have been used to.

Before the start of the last interest rate hike cycle, it wasn’t unusual to see private debt funds lending to firms with debt-to-EBITDA ratios as high as 7 times.

This suggests the upcoming wave of refinancing activity across Europe should offer new lenders the opportunity to recapitalise fundamentally sound companies with conservative balance sheets at a more attractive, lender-friendly yield level. oming due in the next three years, this should give 2023 and 2024 vintages in private credit an additional tailwind.1 This ultimately makes direct lending a much more tenable proposition than it may have been 24 or even 12 months ago.

Finally, the terms on which loans are made are also becoming more favourable. In contrast to previous years, companies no longer have the easy option of borrowing via covenant-lite loans from banks.2

That is because commercial banks in Europe have been scaling back on loan-making. Credit standards are being tightened at the fastest pace since the sovereign debt crisis of 2011 according to European Central Bank data and some 15 per cent of corporate loan applications were rejected in the first quarter of this year - a record.

Which means many businesses have no choice but to accept much tighter terms demanded by private debt funds.

These include stricter rules covering acceptable levels of financial indebtedness and spending, as well as tighter covenants. They are all designed to enhance protections for creditors but also ultimately support companies in building strong and sustainable business models.

With lender protection strengthening, the credit quality of borrowers improving and loan pricing becoming more favourable, we believe the opportunities afforded by direct lending are more attractive than they have been for many years.

Partly for these reasons, the Pictet AM Strategy Unit has highlighted private debt as one of the most promising investment opportunities over the next five years, forecasting average returns in high single digits in Europe – comfortably above what is on offer from high yield credit both in absolute terms and on a risk adjusted basis (please click here to access our Secular Outlook).

No “baggage” – a boost for first-time funds

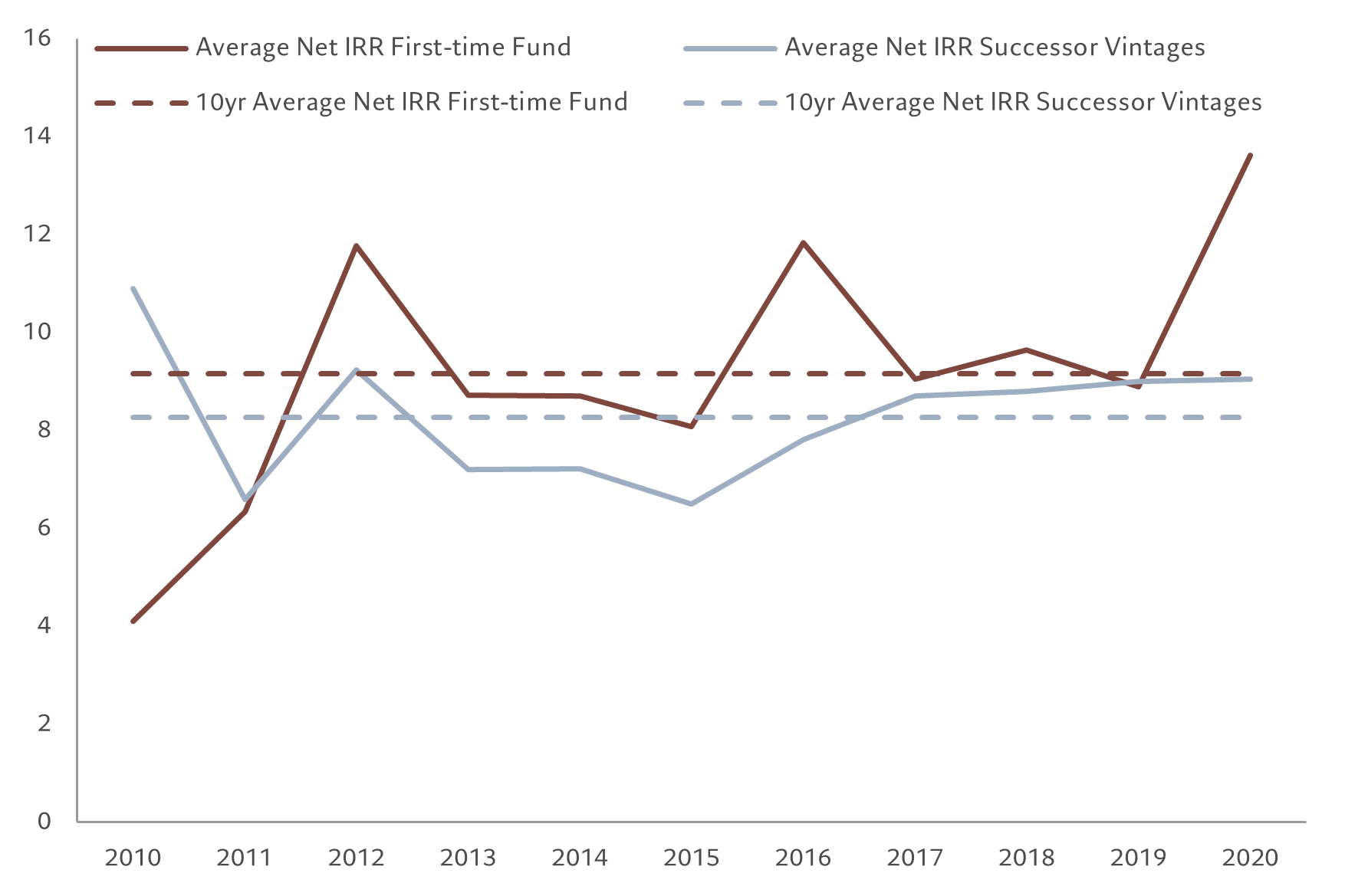

For investors that allocate capital to first vintage private debt strategies, the rewards are potentially even greater.

First vintages typically concentrate lending activities in new niches that offer more opportunities. (At Pictet, we see such a niche among sponsor-less small- and mid-sized European companies, which are often overlooked by traditional private debt funds in favour of bigger private equity-backed deals.)

Moreover, by starting with a clean slate after a period that has seen sharp increases in interest rates, first vintages do not have to deal with debtors struggling with higher borrowing costs. That is in contrast with older large direct lending portfolios, which will inevitably contain stressed assets given the pace at which central banks have tightened monetary policy.

Dealing with such problems is time-consuming for loan portfolio managers, as they have less time to dedicate to origination and selection – both of which are crucial to long-term investment success.

Source: Preqin, Pictet Asset Management. For illustrative purposes only. Data covering period 01.01.2010-31.12.2020.

Niche focus

Small, often non-sponsored and founder-owned European companies (EUR5-15 million EBITDA) with conservative balance sheets and robust capital structures.

Cycle experience

Established investment team with origination and structuring experience throughout the cycle, including during periods of economic stress.

Controlled risk

Diversified across countries and sectors, with focus on low-beta, high-cashflow industries and deals structured to maximise downside protection.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.